The DESK’s Trading Intentions Survey 2021 : Profiles

Bloomberg

Bloomberg has the highest penetration of any provider into the buy-side fixed income trading desk. This year has seen it significantly revise charges to...

Subscriber

Coalition: Dealer fixed income stabilising, in a tale of two quarters

By Flora McFarlane.

Analyst house Coalition’s latest report on investment bank activity has shown mixed results for fixed income, currency and commodities (FICC) in the...

Subscriber

Fixed income’s slow adaptation to payment for research

By Flora McFarlane

While MiFID II’s unbundling rules across the board are in full swing, fixed income is still getting used to the accompanying cultural...

Subscriber

Research profile: DirectBooks’ magic sauce

The DESK spoke with Rich Kerschner, CEO of DirectBooks, to understand what the magic ingredient is behind their success.

What has given DirectBooks the lead...

Subscriber

Survey: Are there missed opportunities in fixed income TCA?

Based on their own view of TCA success, buy-side traders could apply analytics to support trading and execution goals.

The DESK has found that fewer...

Subscriber

The DESK BENCHmark 2017: Mid-sized buy-side have diverse trading

Mid-sized asset managers champion electronic trading - The DESK’s BENCHmark research has found mid-sized firms use electronic trading and a wider range of brokers than...

Subscriber

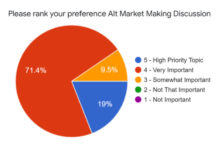

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

Subscriber

Research: Analytics use in trading workflow increases by 72% over three years

Effectiveness for reporting and desk performance assessment improves year-on-year.

The DESK’s latest research into trading analytics has found its use growing within the trading workflow,...

Subscriber

Treasuries HFT hack test results released

The impact of a simulated cyberattack on a high-frequency trading (HFT) firm in the US Treasury (UST) market has been released by the Treasury...

Subscriber

Research: Competition proves tough for O/EMS providers

Onboarding time shows the challenge facing EMS & OMS firms but algo trading increases demand

Two years ago Flextrade had a big pipeline of new...

Subscriber