MARKET NEWS

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Liontrust loses McLoughlin

Head of trading Matthew McLoughlin has resigned from Liontrust Asset Management.

McLoughlin has been a partner and head of trading at the active investment management...

MarketAxess holds US credit trading high ground in April volatility

A burst of spread widening and credit ETF related trading pushed US electronic credit trading to another record in April.

TRACE volumes for investment grade...

Bloomberg broadens EM bond pricing coverage

Bloomberg has expanded its intraday valuation (IBVAL) front office service to cover emerging market (EM) bonds on a 22/5 basis.

Launched in 2023, IBVAL provides...

FEATURES

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

PROFILES

RESEARCH

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

FROM THE ARCHIVES

Insights & Analysis: Central banks’ liquidity retreat heightens funding market risks

The European Central Bank's (ECB) latest briefing paper, 'Managing liquidity in a changing environment,' underscores the critical need for banks to adapt as central...

MarketAxess expands BlackRock partnership Aladdin OEMS integration

MarketAxess is set to expand its decade-long partnership with BlackRock, integrating its credit trading protocols, pricing and data into BlackRock’s Aladdin order execution management...

SEC creates unit to tackle emerging risks

The Securities and Exchange Commission has created the Event and Emerging Risks Examination Team (EERT) in the Office of Compliance Inspections and Examinations (OCIE)....

LIBOR risks growing

Philip Whitehurst, head of service development at clearing house LCH has warned delegates at the Fixed Income Leaders Summit to take FCA warnings seriously regarding...

Joeri Wouters: On the millennial trader

Balancing a trader’s discipline and the curiosity of the millennial generation is creating a strong approach to negotiating the evolving fixed income landscape.

What are...

Fixed income leads the way for revenue growth at Euronext

Euronext saw record income and revenue in Q1 2024, up 8% YoY to €401.9 million.

In the exchange’s results call, CEO and managing board chairman...

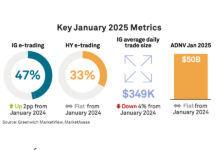

MarketAxess trading volumes dip in static corporates market

US corporate bond markets have had an unexciting start to the year, remaining flat at US$50 billion in average daily notional volumes (ADNV).

Market share...

BlackRock veteran Mitchelson to join Bloomberg

Multiple sources have confirmed that Rob Mitchelson, formerly Europe, Middle East, Africa (EMEA) head of fixed income and FX trading at BlackRock, is to...

Trumid launches continuous bond pricing platform

By Flora McFarlane.

Trumid has announced the launch of its new service, the Fair Value Model Price (FVMP), for continuous bond pricing which produces a...

Thomas Pluta named president-elect at Tradeweb

Tradeweb Markets has named markets veteran Thomas Pluta as its next president. He will join Tradeweb from JP Morgan, where he spent nearly 27...

Trading : Intertwining electronic trading of credit and rates

Electronic market operators are bringing together credit and rates trading platforms in an effort to deliver more efficient execution for traders.

The interplay between the...

Greenwich Associates: Fixed income desks see highest buy-side tech spend

Technology spend on buy-side trading desks rose 4% in 2019 from the previous year, to reach US$2.2 million on average, with fixed-income trading desks...