J.P. Morgan: Finding the best path in e-trading fixed income

Electronic trading may resolve key structural challenges in the market for buy-side traders, including instrument selection, with guidance from key dealers.

Chinedum Nzelu, head of...

Buy-side desks find favour in credit futures

The expansion of Eurex’s credit futures offering into dollar and multicurrency products promises broader and deeper opportunities for investors.

A keen buy-side appetite for credit...

Viewpoint: “Give me six hours to chop down a tree and I will spend...

Neptune’s COO, Byron Cooper-Fogarty, and head of data science, Ben Cohen, discuss the future of “axes” in the fixed income world.

Abraham Lincoln was a...

End to End CSDR Processing – Roles, Responsibilities, and Issues for all Participants

On 22nd July, 2020 a panel of market participants discussed the detailed implications of the Central Securities Depository Regulation (CSDR).

The panel comprised, J.R. Bogan,...

Viewpoint : Beyond MiFID : Gherardo Lenti Capoduri & Umberto Menconi

Thinking beyond MiFID II: a new role for the fixed income broker

By Gherardo Lenti Capoduri, Head of Market HUB, and Umberto Menconi, Business Development &...

ICE: Indexing – the next evolution

ICE offers advancements with customisation, AI and a depth of historical data

The DESK spoke to Varun Pawar, ICE Fixed Income & Data Services’ Chief...

EUREX: Why credit index futures are here to stay

Lee Bartholomew, global head of fixed income and currencies product design, and Davide Masi, fixed income ETD product design at Eurex spoke to The DESK...

IRS electronification: 20 years in the making

With the 20th anniversary of Tradeweb’s interest rate swaps (IRS) marketplace around the corner, the firm’s head of US institutional Rates, Bhas Nalabothula, looks...

Deciphering the Size of the Portfolio Trading Market: Ted Husveth

Ted Husveth, Managing Director, Credit Product Manager, Tradeweb.

In our last blog post, we examined what a typical portfolio trade on our platform looks like...

What is best execution and how can firms achieve it?

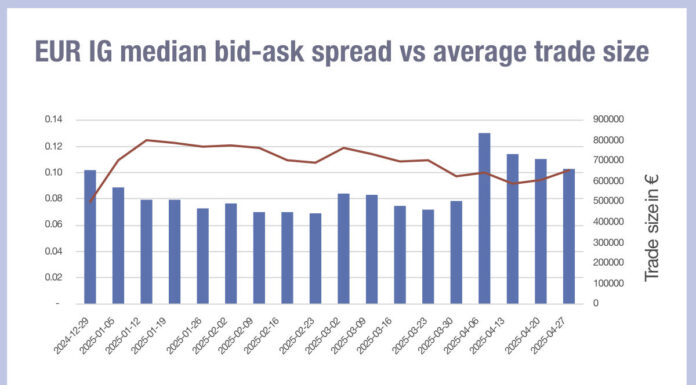

Gareth Coltman, Head of European Product Management, MarketAxess Europe offers his insights.

There is no doubt that MiFID II will have a profound and lasting...