Exclusive: Quinn and Sobel discuss Trumid’s new portfolio trading protocol

Trumid, the fixed income electronic trading platform, has launched a portfolio trading protocol. Designed to simplify and extend electronic portfolio trading for institutional clients...

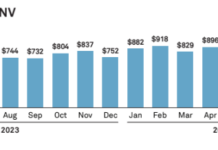

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

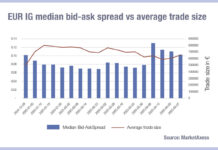

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....

Candriam promotes bond chief to CIO

Candriam, the global multi-asset manager has appointed Nicolas Forest, Candriam’s global head of fixed income since 2013, as its new chief investment officer (CIO),...

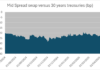

Getting the most out of derivatives in credit

Bond investing has become more exciting in the past two years than in the previous ten, with interest rates and central bank activity fire-fighting...

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

The DESK Research: The state of liquidity for US mid-market asset management firms

In 2022, despite robust secondary trading volumes, many buy-side firms are citing worsening liquidity conditions and dealers have seen falling trading revenues moving into...

Subscriber

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

Oppenheimer & Co adds three MDs to IG sales team

Oppenheimer & Co has hired Perren Thomas, Dennis Megley and Mike Henneberry onto its investment grade (IG) desk. Each will serve as managing directors...

The right way to trade credit

Of course, there is no right way to trade all credit, but there are clearly advantages in trading credit in such a way that...