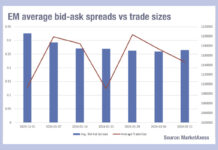

Emerging markets trading costs threaten to rise

Emerging market bond traders will see trading costs rising as volumes begin to decline. According to MarketAxess data from its CP+ pricing tool and...

The summer lull barely touches emerging markets

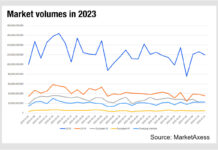

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions....

US credit sees elevated bid-ask spreads

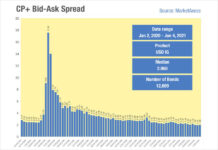

Bid-ask spread remain elevated in US markets across investment grade and high yield, relative to January and February, according to MarketAxess Trax data, which...

Sub-2bps bid-ask spreads in US IG are below pre-crisis levels

The US investment grade (IG) credit market is seeing very tight bid-ask spreads in 2021, according to the Composite Plus (CP+) data supplied by...

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’...

CUSIP issuance up YoY, but March decline signals concern

Year-to-date CUSIP issuance, which is indicative of new debt securities being issued, has increased year-to-date against 2024 figures, according to CUSIP Global Services (CGS).

Its latest...

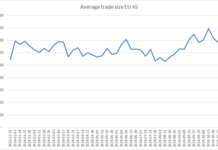

A flying start to 2024 in European bonds may punish traders

The new year has seen a flying start in bond issuance in Europe, with a strong start relative to recent years driving €8.6 billion...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

Trade sizes rise in Europe, fall in US

The end of 2024 indicates is seeing quite different changes to trade sizes in the corporate bond markets of Europe and the US, according...