Tag: MarketAxess

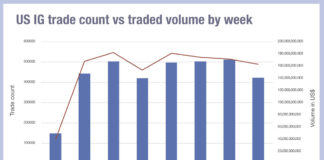

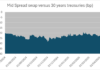

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...

Raj Paranandi resigns from MarketAxess

European and APAC chief operating officer Raj Paranandi is leaving MarketAxess for an external role, the company has confirmed.

Paranandi has been in the role...

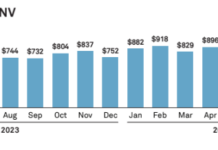

MarketAxess trading volumes dip in static corporates market

US corporate bond markets have had an unexciting start to the year, remaining flat at US$50 billion in average daily notional volumes (ADNV).

Market share...

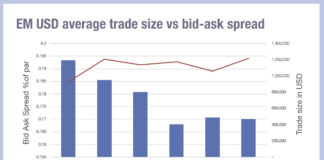

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Strong start of the year in electronic credit trading

Electronic credit markets started 2025 on a strong note, with January's total credit average daily volume (ADV) showing robust growth across platforms. Trumid reported...

Bringing together fixed income trading and global youth empowerment: An emerging...

Founded in 2000 by finance professionals who saw the social inequities in the emerging markets where they invested, EMpower supports hundreds of initiatives that...

MarketAxess hires Steve Tait to lead US dealer execution business

MarketAxess has appointed Steve Tait as head of US dealer execution business - credit.

Tait joins after more than 26 years at JPMorgan, where he...

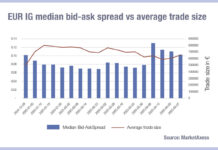

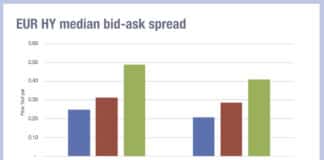

Squeezing the bid-ask spread

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at...

Roberto Hoornweg joins MarketAxess board

MarketAxess has appointed Roberto Hoornweg to its board of directors, effective 1 March.

On his election, Hoornweg said: “I look forward to helping the firm...

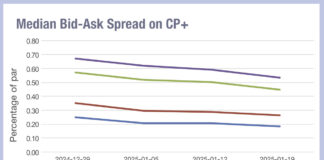

Bid-ask spreads see double-digit tightening in early 2025

Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages...