Interactive Brokers extends trading hours for US Treasuries

Interactive Brokers, an automated global electronic broker, has expanded trading hours for US Treasury bonds on its platform, allowing the firm’s global clients to...

Investor Demand: Barclays study challenges FCA proposals on retail access to corporate bonds

A detailed analysis by investment bank Barclays raises questions about the practical impact of regulatory measures to increase access to corporate bond markets, suggesting...

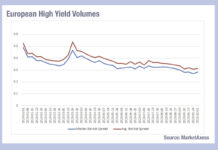

The good news on high yield trading

Two weeks ago we noted that high yield markets have seen trade sizes increase since the start of the year, running counter to the...

The increasing importance of data centres in fixed income

As the fixed income market becomes more electronic, we are seeing an increasing number of firms connecting to data centres around the world. The DESK...

Veiner and Vara named co-heads of global trading at BlackRock

BlackRock has promoted Dan Veiner and Jatin Vara to co-heads of global trading, replacing Supurna VedBrat, who will leave the firm.

“The actions we announced...

The Autonomous Trader

Separating the trading function from portfolio management is a painful exercise, but the benefits can be felt by the end investor. Dan Barnes reports.

Buy-side...

EquiLend rolls out Orbisa securities lending data on Bloomberg Terminal

Equilend, a technology, data and analytics firm, has launched Orbisa securities lending data on the Bloomberg App Portal, providing a dataset comprising US$32 trillion...

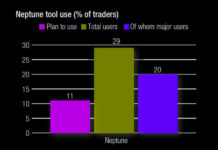

The DESK’s Trading Intentions Survey 2020 : Neptune

NEPTUNE.

The only one of the first-generation, pre-trade data providers to thrive, Neptune is a firm favourite. Described by its interim CEO, Byron Cooper-Fogarty, as...

Subscriber

Europe sees big drops in implied liquidity costs

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment...

Exclusive: Man Group’s proprietary OEMS highlights potential for systematic volume growth

Man Group is now live on an internally developed order and execution management system (OEMS), to trade across asset classes, currently covering corporate credit,...

Fixed income is Nasdaq’s greatest challenge

By Flora McFarlane.

Market operator Nasdaq has reported second quarter revenues from fixed income, commodities and currency (FICC) remained at US$19 million from Q1 2017,...

Securities financing : An integrated approach : Lynn Strongin Dodds

Securities lending comes into its own

How buy-side firms are adapting to the margin regime, by Lynn Strongin Dodds.

Regulation, including tighter margin legislation, has focused the buy-side mind...