Cash is king: investors seek refuge in USD

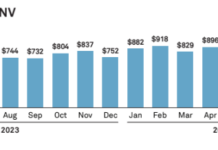

Institutional investors are clamouring for cash as they exercise caution around equities and fixed income over wider macroeconomic uncertainties, according to State Street Holdings...

SEC signs off US Treasury clearing for cash and repo

The US Securities and Exchange Commission (SEC) has adopted a rule designed to reduce risk in the US Treasury market by ensuring that more...

Buy-side fights back against primary market pressure

As new platforms promise to increase efficiency in bond issuance, buy-side firms are looking for leverage to drive change, and not only through technology.

The...

Ediphy Analytics announces ten financial institutions working with its consolidated tape

Data analytics provider Ediphy Analytics is now working with over ten global financial institutions, including Norges Bank Investment Management, Deutsche Bank, Citadel Securities and...

Infront acquires wealth management specialist Assetmax

Financial technology provider Infront is to acquire Assetmax, the Swiss supplier of multi-custody portfolio management, client relationship management and compliance technology

Infront has noted that...

Trading Intentions Survey 2017

The range of credit liquidity aggregation platforms used has increased, reducing demand for new connections.

About the survey

The DESK’s Trading Intentions Survey is global primary research...

Subscriber

Trade associations urge EU to ditch ‘uncompetitive’ active account requirement proposal

A number of trade associations have urged EU policymakers to delete the proposed Active Account Requirement, under the European Market Infrastructure Regulation (EMIR 3.0).

The...

MeTheMoneyShow – Episode Nine

Dan Barnes and Terry Flanagan discuss buy-side perspectives in the latest issue of Global Trading: trading from home, broker relationships, and 'future-proofing' the trading...

Tradeweb : Bhas Nalabothula : Multi-asset trading

How can traders build out their multi-asset trading capabilities?

For buy-side firms to increase low-touch execution capabilities across instruments,new trading protocols are needed. The DESK...

SEC enacts security-based swap execution facilities registration rule

The US Securities and Exchange Commission (SEC) has created a regime for the registration and regulation of security-based swap execution facilities (SBSEFs).

The new regulatory...

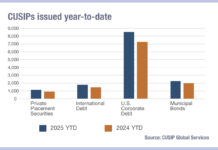

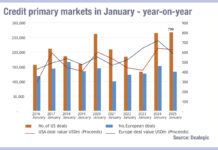

Retreat in credit market primary activity in January 2025, Munis a bright spot

In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis)...

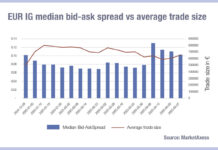

Overbond launches trade size-sensitive AI bond liquidity and pricing analytics

Overbond, the API-based credit trading automation and execution service, has launched artificial intelligence-driven liquidity and price confidence analytics, that are designed to auto-adapt to...