High demand for effective trading protocols

Buy-side traders, whether heavily reliant on voice trading or moving to a more electronic execution model, say they are keen to find effective protocols that...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

Tim Baker joins BMLL to expand firm’s US presence

BMLL, the provider of historical Level 3 data and analytics, has appointed of Tim Baker as senior adviser. Based in New York, Baker will...

Chatham Asset Management fined for improper bond trading

The Securities and Exchange Commission (SEC) has charged New Jersey-based Chatham Asset Management and its founder, Anthony Melchiorre, in connection with improper trading of...

MiFID II/MiFIR text approval likely to take “several weeks”

A source close to the trilogue discussions around the Markets in Financial Instruments Directive and Regulation (MiFID II / MiFIR) has said that talks...

Appsbroker launches Google Cloud market data platform

By Shobha Prabhu-Naik.

Appsbroker has launched Appsbroker Cloud Data, a cloud data platform that delivers market and reference data.

The platform aims to offer lower costs...

EquiLend to launch Swaptimization platform in EU

Securities finance specialist, EquiLend, will be launching its Swaptimization platform in the autumn for financial institutions in the European Union.

The EU launch of Swaptimization,...

IMTC: The Future of Investment Advice & Solutions: Top takeaways from the 2022 MMI...

By Blake Lynch, Head of Sales and Alex Signorile, Sales Executive at IMTC.

We recently attended the Money Management Institute (MMI) conference in Nashville, Tennessee,...

QUODD and S&P GMI expand partnership with data solution

Market data-on-demand provider QUODD has added bond data from S&P Global Market Intelligence into its back-office platform, QX Digital.

QX Digital provides a user-specific experience,...

Mizuho Securities looks to China expansion

Mizuho Securities, a subsidiary of Mizuho Financial Group, has submitted an application to the China Securities Regulatory Commission (CSRD) to establish a securities company...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

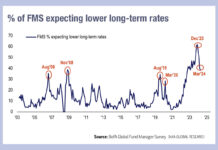

Great Expectations (on rate cuts)

The latest BofA Global Fund Manager Survey has found that 76% of respondents expect two or more Fed cuts in 2024 versus 8% who...