ICMA says execution and order management systems are not trading venues

The International Capital Markets Association (ICMA) has responded to the European Securities and Market Authority (ESMA) consultation into the ‘trading venue perimeter’ by arguing...

Broadridge’s LTX completes integration with Charles River Development

LTX, Broadridge Financial Solutions’ artificial intelligence (AI)-driven digital trading platform, has completed a successful integration with the Charles River Investment Management Solution (Charles River...

Low-code specialist boosted by Bank of America, BNY Mellon and Citi $20 million investment

Genesis Global, the low-code application development platform purpose-built for financial markets organizations, has won US$20 million in new investments from Bank of America, BNY...

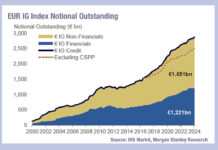

Supply, gross

Debt markets are looking bloated in Europe, with a 33% increase in European non-financial investment grade issuance year-on-year (YoY) year-to-date and a 31% increase...

MarketAxess expands BlackRock partnership Aladdin OEMS integration

MarketAxess is set to expand its decade-long partnership with BlackRock, integrating its credit trading protocols, pricing and data into BlackRock’s Aladdin order execution management...

Danmarks Nationalbank now centrally clears repos at Eurex

Danmarks Nationalbank is now actively trading and centrally clearing repo transactions at derivatives market operator Eurex, which cites the onboarding of the first Nordic...

PBoC & HKMA: No investment quota for northbound Bond Connect trade

The People’s Bank of China (PBoC) and the Hong Kong Monetary Authority (HKMA) have given their approval to the local market infrastructure providers to...

FILS 2021: The five big questions at FILS this year

1. When will we see a functional consolidated tape?

Market structural discussions at FILS will naturally take in European Commission’s plans for the proposed consolidated...

AFME report on rates trading suggests enhanced transparency could boost liquidity

A report by the Association of Financial Markets in Europe, and investment data management provider, Finbourne, has found enhanced transparency could potentially boost liquidity...

Morgan Stanley analysts predicting Q4 was tough for bank FICC revenues

Morgan Stanley analysts, looking at the performance of investment banks in Q4 2021, are predicting a significant fall in revenues across fixed income, commodity...

Investor Demand: Barclays study challenges FCA proposals on retail access to corporate bonds

A detailed analysis by investment bank Barclays raises questions about the practical impact of regulatory measures to increase access to corporate bond markets, suggesting...

Muting Ren joins American Century Investments

Muting Ren has joined American Century Investments on its global Fixed Income Team. He will serve as senior portfolio manager and head of systematic...