The vicious circle of trust and liquidity

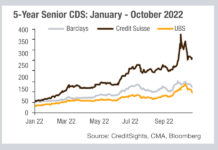

Looking at data provided by CreditSights, we can see the extent of lenders’ concern about Credit Suisse this year. The cost of insuring Credit...

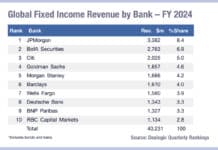

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

The Book: CIF issues six-times oversubscribed Capital Markets Mechanism bond

The Capital Markets Mechanism (CCMM) of the Climate Investment Funds (CIF) has issued its inaugural bond, raising US$500 million from a US$3 billion orderbook.

Tariye...

SEC proposes new central clearing rules for US Treasury market

US market regulator, the Securities and Exchange Commission (SEC) has proposed rule changes to enhance risk management practices for central counterparties in the US...

The Agency Broker Hub: Future trends of retail-size fixed income brokerage and its relevance...

By Massimiliano Raposio, Head of E-Commerce Distribution, Market Hub – IMI CIB Division, Intesa Sanpaolo.

The purpose of this short note is to summarise our views on...

MeTheMoneyShow : The ‘special’ relationship tested by derivatives trading

In this podcast Dan Barnes discusses with Lynn Strongin Dodds the UK’s overtures to the US in getting access to securities and derivatives trading;...

Stuart Taylor to lead electronic trading fixed income at MUFG

MUFG has appointed Stuart Taylor as head of electronic trading within Global Markets for EMEA, Asia and the Americas, effective 20 November 2020.

This newly...

CME Group to launch 20-Year US treasury bond futures on 7 March

Market operator CME Group will expand its benchmark US Treasury futures and options offering with the addition of 20-Year U.S. Treasury Bond futures on...

Lindsey Spink joins American Century Investments as co-head, global fixed income trading

Lindsey Spink has been named co-head of global fixed income trading at American Century Investments (ACI).

He will report to Charles Tan and John...

Industry viewpoint : Get ready for SFTR reporting with MTS

By Tom Harry

SFTR reporting obligations are fast approaching. The first wave of reporting under the Securities Financing Transactions Regulation (SFTR) is set to commence...

Industry viewpoint : Trading U.S. Treasuries : Josh Holden

Beige:

US Treasuries path forward likely to be moulded by lessons of other markets

By Josh Holden,

Chief Information Officer, OpenDoor Trading

At OpenDoor we recently celebrated the...

Coalition Greenwich: Dealers holding long-dated bonds again; net Treasury positions double

Dealers are holding positive levels of longer-dated corporate bonds in their inventories again, and treasury bills drove volume growth in H1 2023, according to...