New SEC Fixed Income Committee to cover liquidity issues this week

By Flora McFarlane.

The Securities and Exchange Commission (SEC)’s Fixed Income Market Structure Advisory Committee, formed in November 2017, will hold its first meeting on...

Beyond Liquidity: Tokenization could improve bond liquidity & transparency

Bond markets could potentially use tokenization to improve efficiency, liquidity and transparency according to the Hong Kong Monetary Authority (HKMA) as consultancy McKinsey said...

Aegon Asset Management appoints global CIO for fixed income

Aegon Asset Management has appointed Russ Morrison as its new global chief investment officer responsible for managing its €170 (US $188) billion fixed income...

Can TCA work for voice/chat credit trades?

Transaction cost analysis (TCA) – or execution quality analytics (EQA) – is a much sought after, but often objectively challenged, service in corporate bond...

Credit : Information overload : Dan Barnes

Dealer axes: Can’t see the wood for the trees

A proliferation of axes and inventories are making dealer data hard to consume by trading desks....

Research profile: Neptune shines bright

The DESK spoke with Byron Cooper-Fogarty, CEO of Neptune, to understand how it keeps delivering for buy-side users.

Axe streaming service, Neptune, has continued to...

Subscriber

European Women in Finance: Nichola Hunter, building fixed income businesses

Shanny Basar talks to Nichola Hunter, head of rates at MarketAxess about leading a start-up, becoming an acquisition target and the growth of electronic...

Santiago Braje joins PGGM

Industry veteran Santiago Braje has joined PGGM as senior investment manager, focusing on emerging markets debt.

In a statement the firm said, “He brings a...

Liquidnet’s direct link from O/EMS to syndicate banks deployed by Charles River

Block trading specialist and agency broker, Liquidnet, has unveiled a new feature in its new issuance platform for corporate bonds, intended to enable investors...

The utopia of the consolidated fixed income tape

Lynn Strongin Dodds explains why Europe cannot look to TRACE as a role model.

Developing a consolidated tape for fixed income in Europe was never going...

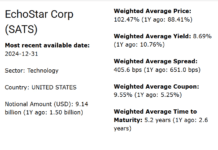

Origination: Issuer profile – EchoStar Corp

EchoStar Corp saw the largest proportional increase in notional debt outstanding in the technology sector in 2024, with a 509% increase, taking it to...

Lutnick on FMX vs CME: “Put us toe-to-toe in the ring and we’re on.”

Interdealer brokers and market operator BGC Group intends to launch its futures exchange for US Treasury and SOFR contracts this summer to compete with...