FTSE Russell Launches Sustainable Fixed Income Indexes

The new index launches address the growing trend of integrating sustainable investment themes into fixed income indexes.

The new index series consists of the FTSE...

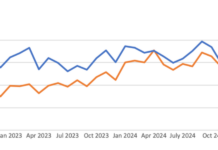

US credit e-trading race tightens, November volumes fall

US credit e-trading volumes dipped for both MarketAxess and Tradeweb in November, the gap between the two platforms narrowing towards the end of the...

Ediphy Markets launches Ediphy Credit

Ediphy Markets has launched Ediphy Credit, a service to help institutional asset managers access better liquidity in corporate bonds. Ediphy Credit combines data analytics...

FILS USA: Entry point for private credit liquidity providers “never been better”

Private credit has expanded rapidly in recent years, with the IMF recently reporting that the size of the market topped $2 trillion globally, of...

Rules & Ratings: Rating agencies hit with US$49 million in SEC fines

The SEC has charged six nationally recognised statistical rating organisations (NRSROs) with failures to maintain and preserve electronic communications. In total, more than US$49...

Tabb: Derivatives boosting access to liquidity into 2019

By Pia Hecher.

Analyst firm TABB Group reports the number of market participants using corporate bond index futures and bond index total return swaps (TRSs)...

Tradeweb sees volume drop in June

Bond market operator, Tradeweb, has reported its average daily volume (ADV) in June was US$780.9 billion (bn), a decrease of 8.9% year-on-year (YoY), largely...

TransFICC investment to deliver e-trading platform with trader desktop

TransFICC, the specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has closed a Series A extension for US$17...

Kempen chooses SimCorp Coric for legacy client reporting

By Flora McFarlane.

Dutch asset manager, Kempen, has selected SimCorp Coric for its reporting solutions, replacing its legacy reporting technology, in response to increasing regulation...

SEI taps IMTC for fixed income portfolio management system

SEI, a provider of investment and technology solutions, will utilise IMTC’s fixed income portfolio management system to provide custom solutions to its clients.

The IMTC...

Trumid announces record platform activity in January

Bond market operator, Trumid, has reported a record month of activity in January 2020 on Trumid Market Center, the company’s electronic bond trading platform....

Dan Toomey poached by Millennium

Dan Toomey has been named senior trader at Millennium, moving from his previous roll as a portfolio manager at Verition Fund Management, a position...