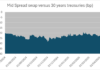

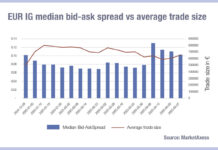

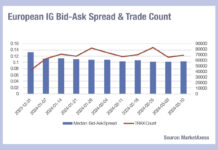

European investment grade seeing smaller, cheaper trades

European investment grade bond traders are seeing a falling bid-ask spread, and a rising trade count since the start of 2024, according to MarketAxess’s...

Yven Scholz promoted at Allianz Global Investors

Yven Scholz has been named head of electronic trading & services at Allianz Global Investors. Prior to his promotion, Scholz was a multi-asset derivatives...

UPDATE: Fed to end supplementary leverage ratio, talks down tapering

The federal bank regulatory agencies today announced that the temporary change to the supplementary leverage ratio, or SLR, for depository institutions issued on 2020,...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...

“Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy

BGC Group’s Q2 earnings call this week wasted no time at all before addressing the ongoing spat between CEO Howard Lutnick and CME CEO...

WBR survey: Buy-side pushed towards price-making and ETF use

By Pia Hecher.

Following the introduction of the new Markets in Financial Instruments Directive (MiFID II), which has formalised best execution reporting, two-thirds of heads...

Subscriber

Technology : How smart is dealer AI? : Dan Barnes

Can artificial intelligence boost broker-dealers’ client coverage?

Simple automation will not work for complex bond markets; tools that learn to find patterns are needed...

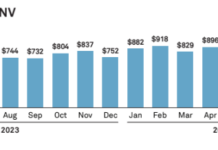

MarketAxess hit 21.5% of investment grade TRACE volume in Q2

Fixed-income market and infrastructure operator, MarketAxess, has seen revenues for the second quarter of 2020 increase 47% year-on-year (YoY) to US$184.8 million, up from...

Greenwich: Nearly half of bond trading desk budgets now spent on technology

New research by Coalition Greenwich has found that the proportion of budget for fixed income trading desks spent on technology grew to 46% in...

Positive reception of FCA consolidated tape plans keeping pace with Europe

A consultation on plans for a consolidated tape of fixed income prices, announced by the UK’s Financial Conduct Authority (FCA), has drawn support from...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

Greenwich Associates: Streaming prices boost buy-side bond liquidity in 2019

By Pia Hecher.

Market intelligence provider Greenwich Associates has announced this year’s market structure trends, reporting that markets will remain volatile and exchanges will become...

Subscriber

![“Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy “Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy](https://www.dev.fi-desk.com/wp-content/uploads/2023/05/Howard-Lutnick_214A_Cantor_900x600-218x150.jpg)