Jon Kroeper, EVP, quality of markets to leave FINRA

Jon Kroeper, executive vice president, quality of markets, is leaving the Financial Industry Regulatory Authority (FINRA).

Kroeper joined FINRA in 2007 and has been responsible...

Chappell leaves Nordea IM as head of fixed income trading

Brett Chappell has left Nordea Investment Managers as head of fixed income trading, with his role being filled temporarily by Jakob Jessen, executive director...

Tradeweb, Trumid close in on MarketAxess’ lunch

Electronic credit closed 2024 on a strong showing with December monthly volume growing 14.7% to US$18.3 billion year–on–year (YoY) while full-year trading volume totalled...

Partnering to revolutionise the buy-side trading experience – Case study

An MTS case study on delivering quality corporate bond data through partnership, collaboration, and integration

This case study presents just one example of how a...

Exclusive: US Bank, KeyBanc Capital Markets and Fifth Third Securities join DirectBooks

US Bank, KeyBanc Capital Markets, and Fifth Third Securities have joined the DirectBooks platform, increasing the total to 22 global underwriters on DirectBooks.

Jimmy Whang,...

Tradeweb completes A$125m Yieldbroker acquisition

Multi-asset market operator Tradeweb Markets has completed its acquisition of Yieldbroker, an Australian trading platform for Australian and New Zealand government bonds and interest...

ICE Data Services publishes key fixed income indices in real time

Market operator, infrastructure and benchmark provider Intercontinental Exchange (ICE) has announced that ICE Data Services has launched real-time publication of several of its most...

Tabb: Derivatives boosting access to liquidity into 2019

By Pia Hecher.

Analyst firm TABB Group reports the number of market participants using corporate bond index futures and bond index total return swaps (TRSs)...

FIX EMEA Trading Conference – Postponed

Novel coronavirus – update for the EMEA Trading Conference 2020

Update as of Monday 9th March

Good evening

It is with extreme regret that the Board and...

Bryan Hall swaps MFS for Maple Capital Management

Bryan Hall has left MFS Investment Management after more than two decades, joining Maple Capital Management as a fixed income portfolio manager.

Hall has spent...

FILS in Barcelona: No clear resolution on data ownership but much good will

The challenges of data ownership and the commercial provision of data were tackled head on, at the Fixed Income Leaders Summit in Barcelona, with...

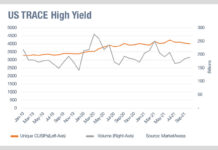

Prioritising investment on the high yield trading desk

When we look at the priorities of trading desks in developing more automated tools, we can consider the longer term market trends as a...