KazMunayGas lists US$2.75 billion of Eurobonds on LSE

London Stock Exchange (LSE) has seen its largest issuance of corporate bonds from the CIS region since 2014. Kazakh oil and gas company, KazMunayGas,...

Bloomberg changes pricing model for fixed income trading – globally

Bloomberg is radically changing its charging model for fixed income trading. It is to apply fees for fixed income trading across its venues in...

FILS 2021: Dealers outline strategy for direct connectivity

Buy-side traders are seeing their sell-side counterparts offering direct streamed prices as an alternative source for data and direct trading, which dealers see as...

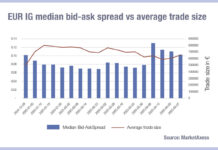

Getting better liquidity through efficient trading

Several new and evolving trends are providing access to pricing and liquidity for buy-side firms, as Olivier Cajfinger, managing director and head of global...

Exclusive: What do buy-side traders think about Citadel’s entry into credit?

We asked senior buy-side trading heads about electronic market maker, Citadel Securities, entry into the corporate bond market as a direct market maker, a...

The reward of risk

By Larry E. Fondren, Founder & CEO, DelphX Capital Markets Inc.

Traditional risk/reward comparisons treat the effective cost of an investment’s risk as a decrement...

US Fixed Income Leaders Summit delayed

The Fixed Income Leaders Summit in Nashville which had been planned to take place in June 2020, has been postponed in light of the...

FILS 2021: The five big questions at FILS this year

1. When will we see a functional consolidated tape?

Market structural discussions at FILS will naturally take in European Commission’s plans for the proposed consolidated...

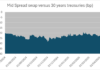

Pre-fight analysis: The weigh-in for CME vs FMX

The launch of FMX, the derivatives exchange chaired by Howard Lutnick, CEO of interdealer broker and services provider BGC Group, sets out a potentially...

Platforms: What the winners are doing right

A few platforms have consistently gained buy-side confidence over the last five years, through smart assistance and simplification of trading workflow.

The three ‘O’s of...

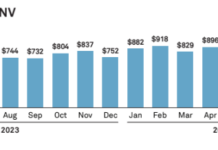

Lower market volumes hitting platforms hard in June

Electronic platforms saw tough market conditions hitting volumes, reflecting lower trading volatility overall in the market, although Tradeweb was able to post net average...

Promotions at Fidelity and SSGA

James Lenton has been named head trader at Fidelity Investments in Hong Kong, where he has worked as a trader since 2017.

A spokesperson for...