Commerzbank’s CEO and chairman quit

Commerzbank has announced that its CEO, Martin Zielke, will resign early on the basis of a mutual termination following a period of poor performance...

Brian Hickey joins LedgerEdge as firm deepens bench

Brian Hickey, a veteran buy-side trader with a long tenure at State Street Global Advisors (SGGA), has joined bond market and distributed ledger specialist,...

Bloomberg cracks?

By Josh Weinberger & Dan Barnes.

The famously holistic service has broken out the Instant Bloomberg chat function for non-terminal users, delivering what looks like...

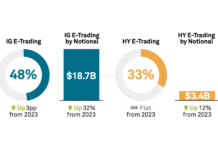

Coalition Greenwich: E-trading boom to outpace market growth in 2025

Nearly half of US investment grade corporate bond trading was electronic in 2024 – and this is only the start, Coalition Greenwich says.

In the...

Technology : Trader engagement : Dan Barnes

Helping traders to think like engineers

The gap between the technology a trading team wants and the technology it gets is often wide; helping them...

Bloomberg veteran Miller joins TT; Dixey moves to Redburn Atlantic; Davies to Liontrust

Bloomberg veteran Gavin Miller has been appointed director of EMEA sales within Trading Technologies’ (TT) fixed income division.

Miller joins TT from BGC Partners where...

Negotiations begin on MiFIR/MiFID final review and consolidated tape

EU member states’ representatives have today agreed a mandate for negotiations with the European Parliament on the proposed regulation reviewing the Markets in Financial Instruments...

Industry viewpoint : All-to-all markets : Mark Goodman

FROM THE VILLAGE TO THE CITY.

MAXIMISING THE BENEFITS OF THE ALL-TO-ALL MARKET.

By Mark Goodman, Managing Director, Global Head of Electronic Trading – FX, Rates and Credit...

BondWave reports volume/liquidity paradox

Trading efficiency has driven down the costs of trading, and supported the ability to find liquidity, despite falling volumes, says BondWave’s Paul Daley, MD...

FILS USA: The three fierce battles for credit e-trading market share

Electronic trading in US fixed income is hotly contested between Bloomberg, MarketAxess, Tradeweb and Trumid all competing for market share of trading cash bonds...

US Treasuries: Coalition Greenwich update on falling interdealer volume and BIS warning

US markets have had an eventful summer according to analysis by Coalition Greenwich, which saw an average daily notional volume (ADNV) for US Treasuries...

MetLife Investment Management acquires Mesirow teams

MetLife Investment Management (MIM) has agreed to acquire the high yield, bank loan and strategic fixed income teams.

The transaction also includes Mesirow’s small-cap equity...