Axe Trading appoint new CEO

Greville Lucking appointed CEO at AxeTrading

LONDON, 13 April 2022 – AxeTrading, the fixed income trading software company, announced today the appointment of Greville Lucking...

Teamwork makes the dream work: Traders can add alpha

There is room for improvement in the relationships between portfolio managers and traders, and without taking advantage of their potential funds could miss out...

European Women in Finance : Sarah Gordon : Making an impact

Senior writer Shanny Basar spoke to Sarah Gordon, CEO of Impact Investing Institute about how impact investing can contribute to the well-being of people...

Bigger / smaller: What sizes are optimal for electronic trading?

Credit trading has been transformed by evolving electronic execution, which has allowed buy-side desks to express investment ideas in to the market using more...

EXCLUSIVE: TradingScreen bought by Francisco Partners

Execution management system (EMS) provider TradingScreen has been bought by private equity firm Francisco Partners for an undisclosed sum. The deal brings to a...

Making the impossible, possible

Confidence in pricing data supports entirely new ways of trading through multiple trading protocols.

The DESK caught up with Matthew Walters, head of product for...

TP ICAP expands MATCHBOOK Rebalance to US

Interdealer broker and market operator TP ICAP, has launched MATCHBOOK Rebalance, an electronic trading solution designed to reduce residual risks in fixed income portfolios,...

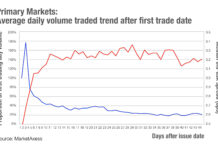

Chart of the week: Get in early

Access to primary bond markets has been a headline topic for buy-side traders over the last four years. As issuance volumes have grown, rising...

‘Whatsapp’ fines for banks hit US$1.8 billion

US market regulators have collectively fined 15 broker-dealers, one affiliated investment adviser, plus the swap dealer and futures commission merchant (FCM) affiliates of 11...

UBS Execution Hub hires multiple senior buy-side traders as expansion continues

According to an internal memo, as seen by The DESK, Ian Power has joined UBS Execution Hub as head of UK execution, one of...

Tim Hill joins MUFG Securities Americas

MUFG Securities Americas has appointed Tim Hill as a director, focused on investment grade credit trading.

Hill joins from Goldman Sachs, where he began his...

Research: Bloomberg, the EMS of choice for fixed income

We analyse the firm’s success in delivering an outperforming execution management system.

This year’s research has found Bloomberg’s fixed income execution management system (EMS), TSOX,...

Subscriber