The Trading Intentions Survey 2015

The incumbent platforms lead the polls, yet clear and significant support is shown for new innovators.

The ‘Trading Intentions survey 2015’ was conducted across 24...

Subscriber

Rathbone Funds adopts Charles River IMS and State Street Alpha Data Platform

Rathbone Funds, the London-based subsidiary of Rathbones Group, has selected the Charles River Investment Management Solution (IMS) to support their equity, fixed income and...

Wellington targets US wealth clients with interval fund

Responding to growing interest in alternative solutions, Wellington Management has launched its first interval fund.

Through the Wellington Global Multi-Strategy Fund, Wellington aims to provide...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners, and benefits.

Three firms have confirmed they will compete to be...

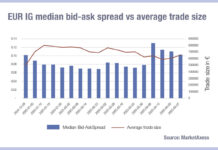

Industry viewpoint: Forging fixed income’s future

How technology is enabling data-driven execution and analytics.

In recent years, the electronification of fixed income (FI) markets has been followed by the development of...

7 Chord’s EM sovereign and corporate bond feed prices on Nasdaq’s Quandl

Predictive bond prices and analytics provider, 7 Chord, has expanded its data offering on Nasdaq's Quandl. Bond investors and dealers can now leverage Python,...

MarketAxess adds directional and currency functionality to portfolio trading

Bond market operator MarketAxess has added new portfolio trading functionality to its platform, to better integrate with a full suite of trading solutions.

The MarketAxess...

FILS in Barcelona: Breaking up the monoculture

Diversity is not always visible, but its impact is. This was the key takeaway from the panel discussing ‘Launching new Diversity, equity and inclusion...

Repurchase disagreements

A calamitous year-end in 2016 has put the broken repo market firmly in the spotlight. Lynn Strongin Dodds reports.

December 2016 saw Europe’s repurchase agreement...

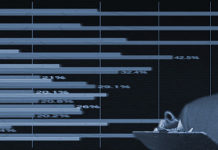

Research reveals deep divisions in trading style set by AUM and geography

Larger firms are able to take advantage of more bespoke trading opportunities, but location matters.

The DESK’s latest trading protocols research has found that the...

Subscriber

Liquidnet integrates bondIT’s AI-driven credit research

Block trading specialist and trade information provider, Liquidnet, and bondIT, supplier of AI driven investment technology, are partnering to integrate bondIT’s Scorable Credit Analytics...

Changing the liquidity dynamic

US treasury traders are seeing enormous shifts in historical volume and trading patterns. Nichola Hunter, CEO of trading venue LiquidityEdge believes that asset managers...