E-trading on the rise in Japanese bonds

Japan’s initially slow adoption of e-trading is increasing in pace as local investors seek liquidity in local and foreign markets, according to a recent...

What EM trade sizes tell us about market evolution

While issuance of emerging markets bonds beat the same period in 2023 by a third, secondary trading is far more choppy, with a stepped...

Overbond integrates Neptune Networks axe data

Overbond, an AI-driven fixed income analytics and trade workflow automation provider, has integrated Neptune Networks’ axe data to help buy-side traders more efficiently discover...

FILS USA: The complexities of routing an order

A great session on selecting trading protocols at the Fixed Income Leaders Summit in Boston, allowed traders to consider what really say behind counterparty...

Cowen Outsourced Trading picks TORA OEMS

Cowen Outsourced Trading has selected TORA’s Order and Execution Management System (OEMS) for fixed income trading across USA, Europe and Asia.

Cowen selected TORA’s software-as-a-service...

Beyond Liquidity: T+1 Testing Begins

DTCC, the US post-trade market infrastructure, formally started the testing program for moving to a shorter settlement cycle on 14 August so market participants...

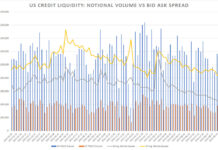

BOB Secondary: US Credit has never had it so good

Liquidity in US credit has improved significantly over the past year, with bid-ask spreads lower than any point in 2022, according to MarketAxess’s CP+...

Greenwich Associates: Growing dealer-client instability

By Pia Hecher.

Market intelligence provider Greenwich Associates found that between 2014 and 2018, there was a 50% increase in the median size of clients’...

Trumid announces strategic relationship with Goldman Sachs

Bond market operator, Trumid, has set up a new strategic relationship with Goldman Sachs. Goldman will join Trumid’s Attributed Trading network and use Trumid’s...

Asset managers offering lower discount to promote new bond fund launches than equity funds

The launch of 'early-bird' share classes by asset managers is no longer uncommon in Europe according to research firm Fitz Partners, which now tracks...

Derivatives : Migrating benchmarks : Dan Barnes

LIBOR: WHEN TO JUMP ON THE SOFR

The transition from the London Interbank Offered Rate (LIBOR) to overnight indexed swap rates is moving, but when...

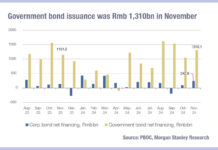

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...