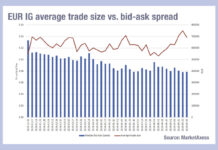

Is European credit electronification bouncing back?

There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found...

Jupiter AM: Training to trade against heavyweight rivals in fixed income

Jupiter Asset Management has trained its trading team on data and analytics in order to beat its rivals to the punch when finding liquidity...

Exclusive: TS Imagine connects with TDS Automated Trading for muni market-making

Trading systems provider, TS Imagine, has connected to municipal bond market maker TDS Automated Trading (TDSAT), through its TradeSmart Fixed Income execution management system...

Citi, Asian Infrastructure Investment Bank issue first digitally native note

Citi has served as dealer as well as issuing and paying agent on the issuance of the Asian Infrastructure Investment Bank (AIIB)'s first digitally...

European Women in Finance: Isabelle Girolami – A fresh attitude to risk

Isabelle Girolami has been CEO of LCH Ltd. since 1 November 2019. She has since had to deal with a global pandemic requiring employees...

Burton-Taylor: S&P and IHS Markit merger creates intriguing synergies in data

On 30 November 2020, S&P Global and IHS Markit announced that they have entered into a definitive merger agreement to combine in an all-stock...

The positive impact of desktop interoperability on trade execution – David Rickard

Traders can add more value in analysis and decision-making than they can as connections between systems.

Removing operational bottlenecks allows buy-side traders to provide better...

Global investor confidence rises, European confidence falls

State Street Global Markets has found that, despite recent market fluctuations, the State Street Investor Confidence Index (ICI) for May 2022 increased to 97.1,...

Trading places – From bonds to fixed income ETFs

Phil Cichlar, Head of Fixed Income Sales & Trading at Jane Street shares his insight on the burgeoning ETF market.

Fixed income exchange-traded funds (ETFs)...

Viewpoint : CDM : Massimo Morini & Andrea Prampolini

CDM FOR SECURITIES: THE MISSING DIGITAL LINGUA FRANCA?

By Massimo Morini, head of interest rates & credit models, and Andrea Prampolini, head of financial markets...

TS Imagine and IHS Markit partner in European fixed income data

TS Imagine, the cloud-based multi-asset order and execution management system (OEMS) provider and IHS Markit have partnered to allow the OEMS TradeSmart platform, in...

Sterling dealers recommend SONIA as alternative to LIBOR

The Bank of England’s Working Group on Sterling Risk-Free Reference Rates – a group of major dealers active in sterling interest rate swap markets – has...