Technology: Educating data

Can better pre-trade data really unlock liquidity in frozen fixed income markets?

If buy and sell-side bond traders are to see real benefits from the...

Bloomberg to buy Broadway Technology in boost to rates trading

Bloomberg has entered into an agreement to acquire Broadway Technology, a fixed-income execution management system (EMS) provider. This acquisition will help Bloomberg to...

Schroders’ former head traders return to senior roles

Rob McGrath, former global head of trading at Schroders, and Nick Robinson, former head of trading for Fixed Income and Active FX at Schroders,...

MeTheMoneyShow – Episode Eight

Shanny Basar and Dan Barnes discuss the latest outsourcing trends in the trading and post-trade space, particularly the aggregation of trading desks within larger...

ICE: Muni Bonds – an interview with Ed Paulinski

In ICE’s series ‘The Munis Ecosystem’, ICE gathers experts from across the sector: issuers, portfolio managers, pricing & analytics, trading and climate experts, to...

“Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy

BGC Group’s Q2 earnings call this week wasted no time at all before addressing the ongoing spat between CEO Howard Lutnick and CME CEO...

John Rothrock named head of DirectPool

CastleOak Securities, the New York-based boutique investment bank, has hired John Rothrock III as managing director and head of DirectPool, its Fixed Income Electronic...

Fixed income ETFs struggling with liquidity crisis

Fixed income exchange traded funds (ETFs) are reportedly struggling in the current liquidity crisis, while their market makers are trying hard to get delta...

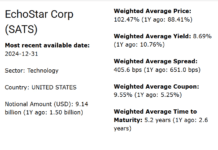

Origination: Issuer profile – EchoStar Corp

EchoStar Corp saw the largest proportional increase in notional debt outstanding in the technology sector in 2024, with a 509% increase, taking it to...

TORA integrates BondCliQ’s US corporate bond consolidated quote and trade data

Order and execution management system (OEMS) provider, TORA, has integrated its OEMS with BondCliQ’s US corporate bond consolidated quote and trade data. The integration...

MarketAxess launches centralised marketplace with integrated rates trading

Electronic bond market operator, MarketAxess, has launched a centralised fixed income trading marketplace integrating rates trading capabilities within the MarketAxess trading system.

MarketAxess acquired government...

SoftSolutions’ new testing-as-a-service environment live

SoftSolutions, the fixed income trading technology provider, has announced that a major Scandinavian bank is completing testing of the latest version of nexRates using...

![“Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy “Complete misunderstanding … or try[ing] to baffle people”; Lutnick counters Duffy](https://www.dev.fi-desk.com/wp-content/uploads/2023/05/Howard-Lutnick_214A_Cantor_900x600-218x150.jpg)