Russell Feldman named CEO of IMTC as it raises new funding

IMTC, a provider of fixed income investment management technology, has secured its first external funding round, which was led by Nyca Partners. This investment...

TP ICAP launches new brand for trading data and analytics

Interdealer broker, market operator and data provider TP ICAP Group has launched the brand Parameta Solutions as the new identity of its data, analytics...

Governance key to EU consolidated bond tape’s success

The International Capital Markets Association (ICMA) has published a report outlining the possible routes to delivering a successful consolidated tape of price data of...

MeTheMoneyShow – Episode Nine

Dan Barnes and Terry Flanagan discuss buy-side perspectives in the latest issue of Global Trading: trading from home, broker relationships, and 'future-proofing' the trading...

Market data costs in spotlight under new FCA review

The UK’s Financial Conduct Authority (FCA) has issued a call for input (CFI) to better understand how data and advanced analytics are being accessed...

Buy side issues framework to standardise bond issuance

The Credit Roundtable, a buy-side lobby group for bondholder protection has issued an ‘Investment Grade Primary Best Practices Framework’ designed to improve bond issuance.

The...

Market data ‘Bill of rights’ opens discussion on transparency, accessibility and ownership

A week after the UK’s Financial Conduct Authority announced a consultation into buy-side access to data and benchmarks, bond pricing specialist BondCliQ and data...

EC: ESMA should run consolidated tape for fixed income

By Flora McFarlane.

An expert group organised by the European Commission to analyse the European corporate bond market has issued recommendations aiming to make issuance...

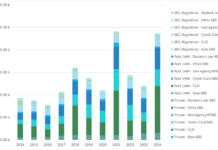

Insights & Analysis: SEC new datasets show 2024 was a boom year for ABS

New regulatory data published by the Securities and Exchange Commission’s (SEC) Division of Economic and Risk Analysis shows US asset-backed securities issuance almost doubling...

Why buy-side firms are building their own primary market tools

Interoperability is not a competitive issue; clients will build it if platforms do not supply it.

There is not a consensus on who should make the bond...

The utopia of the consolidated fixed income tape

Lynn Strongin Dodds explains why Europe cannot look to TRACE as a role model.

Developing a consolidated tape for fixed income in Europe was never going...

Broadridge using OpenFin for PM and trader workspace

Broadridge Financial is to use OpenFin’s operating system for financial desktops for its new digital workspace solution. The tool is designed to support asset...