Tradeweb expands data access through AWS collaboration

Market operator Tradeweb is collaborating with Amazon Web Services (AWS) to broaden access to its US Treasury and UK Gilt closing price data through...

Morgan Stanley reports Q3 trading revenues down 14% year-on-year

Morgan Stanley has reported its Q3 results, with trading taking a hit. The firm saw trading revenue US$2.86 billion, down from US$3.33 billion in...

Trumid: Portfolio trading comes of age

For an institutional investment manager that needs to add or reduce risk in its corporate bond portfolio, being able to trade a custom basket...

Daniel Mayston leaves BlackRock

Daniel Mayston has resigned from BlackRock after nearly 20 years at the world’s largest asset manager, according to sources close to the company.

Mayston was...

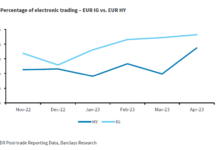

‘Tis better to give than to receive? How ELPs affect credit trading

In a Christmassy spirited theme, The DESK considers how the advantages of electronic liquidity provision can support credit markets – and how the reception...

Viewpoint: Lifting the pre-trade curtain

Michael Richter, an executive director at S&P Global Market Intelligence, and head of the Transaction Cost Analysis (TCA) business for EMEA explains the key...

MTS: Building a better interest rate swaps market

Tom Harry, Head of Cash, Derivatives & Regulation Product Management at MTS

MTS has a strong track record of building robust interdealer and dealer-to-client franchises,...

Do regulators understand ‘best execution’ in corporate bond markets?

What is best execution in bond markets?

In fixed income a best execution process matches up trade metrics to the investment parameters.

“Trading is simply how...

E-trading fixed income volumes rose in October with risk assets facing headwinds

Electronic trading platforms saw net growth in the fixed income space for October, although risk assets faced headwinds.

Tradeweb saw its total trading volume for...

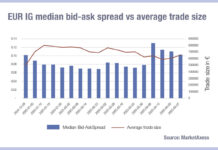

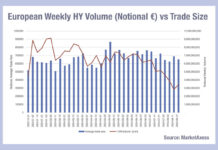

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...

Staying the course: Outlook for 2018

By Boon Peng Ooi, chief investment officer for fixed income, at Eastspring Investments.

Over the past two years, a “strategy” of “tactically” trading risk has...

Trumid upgrades US corporate bond predictive pricing tool

Trumid launches its enhanced Fair Value Model Price (FVMP) tool, which aims to deliver predictive pricing for around 22,000 US corporate bonds every 30...