How big is portfolio trading in corporate bond markets?

Recent reports from market participants have given slightly different estimates for the use of portfolio trading in US corporate bonds, however the consensus is...

The Book: JP Morgan rules the roost in Q1 DCM market share

JP Morgan has retained its top spot in global debt capital markets rankings by volume for Q1 2025, according to Dealogic.

With US$178.5 billion, 806...

AXA IM confirms it is offering outsourced trading

AXA Investment Managers has confirmed it has begun to offer outsourced trading to smaller firms.

“Due to the squeezing of margins and the need for...

Is the market braced for another sell-off?

Traders are reporting the positive effects of innovation upon market liquidity but central banks hold all the cards.

The association between the Covid 19 pandemic...

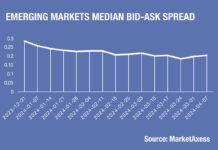

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year,...

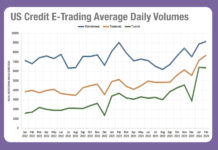

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

FILS 2022: Market endures despite liquidity squeeze; strong dollar remains safe haven

The macroeconomic fallout of Russia’s invasion of Ukraine will continue to constrict liquidity for Europe’s fixed income markets and dictate central bank monetary policy...

Technology: The real reason you cannot get a new trading system

Lynn Strongin Dodds investigates the barriers to adopting new technology.

Technological advances may be developing at breakneck speed but many of the barriers of adoption...

Analysis: E-trading platforms see gains and losses in corporate bond market battle

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

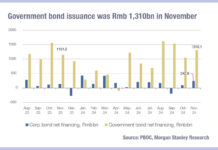

China government bond issuance reducing transparency of total social finance

Understanding state support for the economy in China can be measured across several dynamics, but debt provision to the non-financial private sector, known as...

How Fed bond buying is impacting markets

The Federal Reserve Bank of New York is hoovering up assets in order to support corporate borrowing in the US, and subsequently creating some...

SEC committee signals direction for US credit rules

New fixed income committee sees pushback on structural approach to resolving credit market challenges. David Wigan reports.

As European fixed income market participants get their...