ECB expected to cut rates this month

A rate cut by the European Central Bank (ECB) is “fully expect” this September, according to DWS Group European economist Ulrike Kastens.

Kastens predicted a...

IMTC: Technology & The Future of Fixed Income

Technology & The Future of Fixed Income: How embracing new technology is critical to staying relevant in fixed income investment management

By Russell Feldman, Chief Operating...

“Fundamentally flawed […] inadequate”; SIFMA slams SEC’s best execution proposal

In a recent post from the Securities Industry and Financial Markets Association (SIFMA), former chief economist and director of the Division of Economic and...

Citi develops blockchain FX solution under Monetary Authority of Singapore Guardian project

Citi has developed an application that uses blockchain infrastructure to price and execute bilateral spot foreign-exchange (FX) trades.

The application is a part of Project...

Alaa Bushehri promoted at BNPP AM

BNP Paribas Asset Management (BNPP AM) has appointed Alaa Bushehri as head of emerging markets debt. She reports to Olivier de Larouzière, chief investment...

Overbond launches trade size-sensitive AI bond liquidity and pricing analytics

Overbond, the API-based credit trading automation and execution service, has launched artificial intelligence-driven liquidity and price confidence analytics, that are designed to auto-adapt to...

AFME finds sell-side fixed income data spend up 50% over five years

A study by the Association of Financial Markets in Europe (AFME) has provides a new view of rising fixed income data costs in eight...

ASEAN exchanges push for sustainability progress

Executives at ASEAN exchanges have agreed on four proof-of-concepts to follow over the next three years, continuing their sustainability initiatives.

The objectives, determined at the...

Brokertec data shifts to Bloomberg with Reuters/Dealerweb data tie-up

By Shobha Prabhu Naik & Dan Barnes.

Bloomberg, the financial data provider, has launched a new data service that will take NEX’s BrokerTec US Treasuries...

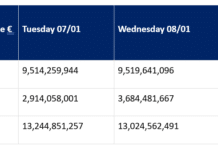

Gilt activity spikes as new rates reality bites government borrowers

By Dan Barnes and Etienne Mercuriali

Gilts market opening on the morning of 9 January suggested some traders took a big hit, with stop losses...

Viewpoint: “Give me six hours to chop down a tree and I will spend...

Neptune’s COO, Byron Cooper-Fogarty, and head of data science, Ben Cohen, discuss the future of “axes” in the fixed income world.

Abraham Lincoln was a...

Derivatives : Exchange-traded products : Joel Clark

Why listed derivatives struggle to address risk

Some traders have been critical of listed products designed to replicate OTC derivatives, but exchanges are working hard...

![“Fundamentally flawed […] inadequate”; SIFMA slams SEC’s best execution proposal “Fundamentally flawed […] inadequate”; SIFMA slams SEC’s best execution proposal](https://www.dev.fi-desk.com/wp-content/uploads/2024/08/Craig-Lewis-e1723191687527-218x150.jpg)