The Agency Broker Hub: The fixed income ETD market – what are 2022’s main...

By Carmine Calamello, Head of Brokerage & Execution, Market Hub, Intesa Sanpaolo, IMI CIB Division.

After a decade of expansionary monetary policy and interest rates close...

Investor Demand: BofA Global Fund Manager Survey sees bullish US investor appetite

The Bank of America Global Fund Manager Survey (FMS) conducted Nov 1st-7th; post-US election, found that respondents have higher global and US growth expectations,...

Yieldbroker partners with IHS Markit to support Australian bond issuance

Data, analytics and trading solutions provider IHS Markit is collaborating with Yieldbroker, the electronic trading platform for Australian and New Zealand debt securities and...

Tradeweb executes first electronic SONIA swaps vs Gilt futures

Fixed income market operator Tradeweb has facilitated its first electronic execution of SONIA swaps against Gilt futures for institutional investors. The electronic transaction was...

Exclusive: Mediobanca’s rapidly growing credit business adds Marco Cravero as head of flow

Marco Cravero has joined Mediobanca in Milan as executive director and head of fixed income flow, as the bank seeks to expand its existing...

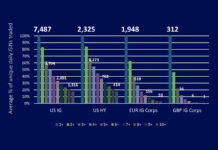

Comparing Corporate Bond Liquidity Across Regions

By Grant Lowensohn and Hidde Verholt.

Highlights

The US corporate bond market offers a significantly greater number of ISINs with high daily trade counts than other...

PLSA: Absorbed research costs must not impede transparency for investors

By Flora McFarlane.

The majority of large asset managers are opting to absorb research costs rather than pass them onto clients, but investors must investigate...

Subscriber

BondWave releases new version of Effi

Technology provider, BondWave, has released the newest version of its fixed income portfolio and transaction analytics platform, Effi 3.17

The new release expands BondWave’s suite...

ESMA moves to tighten up algo surveillance

Algo trading has grown increasingly complex over the last decade. In 2007, the Markets in Financial Instruments Directive (MiFID) permitted competition with the national...

Glue42 aims to boost buy and sell-side internal collaboration

Glue42, the desktop tools integration specialist, has released a new version of its open-source platform, Glue42 Core. The new release, version 2.0, is designed...

Mizuho EMEA joins Neptune to distribute real-time axe data

Mizuho EMEA has joined Neptune Networks, the fixed income network for disseminating real-time axe data.

Neptune delivers axes from 32 of the leading dealers...

Germany issues first tokenised bonds on DLT during ECB trials

Clearstream, DekaBank and DZ Bank have issued two tokenised €5 million bonds using distributed ledger technology (DLT).

The bonds were issued during the ECB’s trials...