Rules & Ratings: Covered clearing agencies subject to new risk management rules

The SEC has amended rules related to the risk management and resilience of covered clearing agencies, introducing new requirements around intraday margin collection and...

Bloomberg launches US Treasury dealer algos to expand buy-side access to liquidity

Bloomberg announces the completion of the first trade using its newly launched US Treasury (UST) Dealer Algos.

This first-to-market solution provides buy-side clients with broader...

EUREX: Why credit index futures are here to stay

Lee Bartholomew, global head of fixed income and currencies product design, and Davide Masi, fixed income ETD product design at Eurex spoke to The DESK...

EU-UK financial services regulatory framework to be agreed by March 2021

The draft Trade and Cooperation Agreement between the United Kingdom (UK) and European Union (EU), which has been supported by the Europe Union and...

IDX 2024: Divergence or convergence for EU and UK regulation?

Regulation is an ever-changing beast; panellists at this year’s International Derivative Expo conference provided updates on new mandates, progress being made and how implementation...

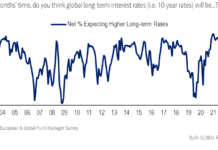

BofA: ‘Universal gloom’ in fund manager survey

The latest fund manager survey by BofA has found that a net 92% of survey participants expect a recession in Europe over the next...

“Way more flexibility than at Eurex”: Euronext announces govie mini-futures

Euronext is launching cash-settled mini-futures on European government bonds this September, which it says are the first offering of this kind in Europe.

“This is...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

The advantages of derivatives trading

There can be valuable benefits to using derivatives as part of a portfolio.

Bringing derivatives into a fund’s mandate requires client appetite, portfolio management and...

TD Securities becomes LCH SwapAgent member

TD Securities is now live as a LCH SwapAgent member, the first Canadian bank member, bringing membership up to 44 from across 12 countries.

The...

Data – Can buy-side firms share bond-trading data?

Asset managers agree they need access to more trading data, but have struggled to share it effectively between themselves.

The paucity of access to bond...

Propellant.digital reports rapid uptake of its bond data analytics

Vincent Grandjean, CEO of analytics software provider Propellant.digital, is pleased with the firm’s progress to date.

“We are live with clients and bearing in mind...