Analysis: E-trading platforms see gains and losses in corporate bond market battle

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

FILS USA 2022: Focus on liquidity

As fixed income market participants eye the threat of a further back-up in yields, liquidity sourcing is being reassessed.

While technology has greatly advanced the...

Fixed income dominates LSEG and Deutsche Borse Q3 revenue

Fixed income revenue led the banks’ Q3 results, boosting overall growth.

LSEG’s capital markets revenue was up 24.8% year-on-year (YoY) in Q3 2024, reaching £468...

Making a credit desk simpler

Getting a clear picture of the complex corporate bond market means that at some point, a lot of information has to be brought together...

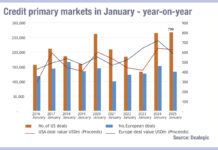

Retreat in credit market primary activity in January 2025, Munis a bright spot

In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis)...

US fixed income issuance down 12%, ADV up 13.5%, in Q3 2023 YoY

Total US fixed income issuance for Q3 2023 saw a 12% drop (from US$1.8tn) against the same quarter in 2022, and down 12.8% against...

Subscriber

CanDeal extends hours to reach European investors

By Aulia Beg.

Canadian fixed income platform CanDeal has extended its opening hours to capture more of the the European trading day. It will now...

Buy-side desks swing extra US$2.1 million into fixed income trading technology

By Sobia Hamid.

On average buy-side fixed income desks pushed US$2.1 million of additional budget into technology in 2016, according to new research from analyst...

Invesco’s 2023 Fixed income outlook: ‘A promising year after a painful selloff’

Invesco has published its outlook for fixed income markets in 2023, noting that valuations now look more attractive, and yields are higher than they...

Research Profile: Neptune

In the 2024 Trading Intentions Survey, 53% of respondents reported being users of Neptune’s electronic axe distribution platform, with 24% counting themselves ‘major users’,...

Subscriber

Treasury futures open interest shows record uncertainty; surpasses 17 million contracts

Derivatives market operator, CME Group, reports that open interest (OI) in its US Treasury futures reached a record 17,222,551 contracts on 12 May, the...

Adaptive Auto-X creates choice in trade automation

Developing automation to suit a range of market environments has put MarketAxess’s clients ahead in the drive for more efficient trade execution and adaptable...