Derivatives : Migrating benchmarks : Dan Barnes

LIBOR: WHEN TO JUMP ON THE SOFR

The transition from the London Interbank Offered Rate (LIBOR) to overnight indexed swap rates is moving, but when...

Bridgewater and SSGA launch ETF as alt demand grows

Bridgewater Associates is launching an actively-managed retail ETF in partnership with State Street Global Advisors (SSGA) as demand for alternatives continues to rise. The...

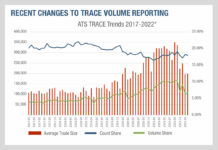

What FINRA’s trade reporting changes tell us about consolidated tapes

Understanding the difference between commercial and public data offerings is crucial for data users. A good example of this difference can be found with...

UBS integrates Bond Port with iQbonds to increase counterparty diversity

UBS has integrated its Bond Port trading venue with iQbonds, the bond trading platform of software provider valantic.

iQbonds is heavily used in the German...

ISDA has named Jeroen Krens as board chair

The International Swaps and Derivatives Association (ISDA) has appointed Jeroen Krens as its new board chair, effective 1st of January 2025. He succeeds Eric...

FILS Amsterdam: Traders are fighting on several fronts

By Dan Barnes.

Traders are still fighting for better data and transparency – in the right places – at FILS Amsterdam 2018, but the elephant...

ICMA: Adopt data-driven approach to MIFIR RTS 2 post-trade deferral framework

The International Capital Market Association (ICMA) has co-signed a cross-industry statement on the MIFIR RTS 2 post-trade deferral framework for bonds, calling for a...

7 Chord to integrate Glimpse Markets’ bond transaction data

7 Chord, an independent provider of predictive prices and analytics to fixed income traders, issuers, and investors, has become the first AI pricing vendor...

Tradeweb saw ADV hit US$1 trillion in January 2021

Market operator Tradeweb has reported its total trading volume for January was US$20 trillion across its electronic marketplaces for rates, credit, equities and money...

LIST completes second phase of client migration onto Euronext Optiq trading platform

ION subsidiary LIST has completed phase two of the migration of its Borsa Italiana clients on to Euronext’s Optiq technology trading platform.

Following a successful...

Aité: Buy-side desk sophistication is driving EMS innovation

A new report by analyst firm Aité, entitled, ‘OMS/EMS Convergence in the Cloud: Better Together’, author Spencer Mindlin has identified two major trends in...

BoE’s limited window could punish the gilt-y

The Bank of England’s limited UK government bond (gilt) purchase operations have been confirmed to close on Friday, putting tight brackets around buy-side firms’...