Bank of England releases detail on index-linked gilt purchases as LDI woes continue

The Bank of England (BoE) has said it continues to monitor developments in financial markets very closely in light of the significant asset repricing...

OMS market: Vendors focusing on strategic sales pitch

Research suggests that an apparently limited interest in changing order management systems (OMS) on buy-side trading desks has been overcome by OMS vendors at...

Surprise at inaccurate US election poll predictions has increased volatility

With a victory for either side being far from clear in the US election, investment commentators have warned of sustained volatility across asset classes....

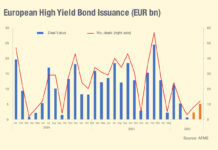

AFME update: European HY bond issuance fell nearly 60% year-on-year

A new report by AFME found that the primary high yield bond market decelerated significantly in Europe at the start of this year.

High yield...

FIX Trading Conference in September will be virtual and global

FIX Trading Community, the non-profit, industry-driven standards body will deliver its EMEA Trading Conference, scheduled for the 18 September 2020, in an immersive virtual...

Cboe Global Markets: Newer, more diverse liquidity in EM markets

A new set of emerging market credit futures is expanding the range of trading and investment support for specialist and multi-asset EM investors.

Nick Godec...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Adaptive names Dave Clack as chief product officer

Adaptive Financial Consulting has named Dave Clack as chief product officer, a newly created role as the firm looks to focus on its infrastructure...

Viewpoint: Technology and the evolution of fixed income trading

Steve Toland, co-founder TransFICC

The fixed income and derivatives market is evolving, rapidly migrating away from the phone onto electronic venues. Electronic trading satisfies the...

Credit : Back for good : David Wigan

Cautious optimism on Dodd Frank roll-back.

The US regulatory response to the financial crisis has shifted trading risk from sell-side to buy-side desks, making reform welcome....

Five lessons from the closure of LSEG’s CurveGlobal

CurveGlobal, the interest rates derivatives market launched in 2016, is to run down its business before closing on Friday 28 January 2022, according to...

Fractional exchange BondbloX ‘democratises’ global access to bond markets

BondbloX Bond Exchange (BBX), a fractional bond exchange, has made its platform that tracks and trades bonds available for individual investors in an effort...