Direct price streaming will transform credit trading

Banks are providing corporate bond pricing feeds direct to clients shaping new potential execution paths. Dan Barnes reports.

Big investment banks including Morgan Stanley, UBS...

JWG-IT: Buy side overstretched and under-prepared for MiFID II

By Flora McFarlane

According to a new JWG survey, 90% of buy-side firms believe they are at significant risk of non-compliance for the incoming January...

On The DESK : Stuart Campbell : BlueBay Asset Management

STUART CAMPBELL: OUTPERFORMANCE AND AUTO-EXECUTION.

Leading the charge into electronic trading, Stuart Campbell tells The DESK how he has set up his team to prevail.

Which characteristics...

Four drivers of Brazil’s increasingly complex corporate credit market

The Brazilian corporate credit market is becoming increasingly complex, and active bottom-up selection is essential for identifying winners and losers in this shifting environment.

That’s...

Promotions at Fidelity and SSGA

James Lenton has been named head trader at Fidelity Investments in Hong Kong, where he has worked as a trader since 2017.

A spokesperson for...

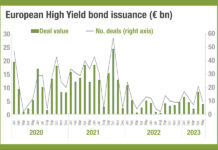

High yield issuance may bounce back

The data for Q1 bond issuance in European high yield (HY) markets shows that it fell 22.7% according to the Association for Financial Markets...

ASX loses AUS$250 million on failed blockchain settlement project

The Australian Stock Exchange (ASX) has pulled its project to replace its existing settlement system, CHESS, with a blockchain-based settlement system.

The project, which has...

The positive impact of desktop interoperability on trade execution – David Rickard

Traders can add more value in analysis and decision-making than they can as connections between systems.

Removing operational bottlenecks allows buy-side traders to provide better...

Fixed income dominates LSEG and Deutsche Borse Q3 revenue

Fixed income revenue led the banks’ Q3 results, boosting overall growth.

LSEG’s capital markets revenue was up 24.8% year-on-year (YoY) in Q3 2024, reaching £468...

Barclays survey finds half of clients trade 90% of rates tickets electronically

Barclays’ Market Structure team has released its third annual survey of bond market electronic trading for buy-side clients.

In rates markets, when asked what...

Tradeweb and FTSE Russell launch US Treasury closing prices

Tradeweb and FTS Russell have expanded their fixed income pricing partnership with the launch of Tradeweb FTSE US Treasury Closing Prices.

The service provides closing...

Bond trading boosts BNP Paribas’s FICC revenues

BNP Paribas’s investment bank delivered double digit revenue growth in 2019, with revenues for Fixed Income Currencies and Commodities (FICC) up by over 30%....