Allianz GI joins Glimpse Markets’ data sharing initiative

Allianz Global Investors, which has US$510 billion in assets under management, has joined Glimpse Markets, an initiative to support buy-side data sharing in the...

James Rubinstein new Americas head of execution and quantitative services at Liquidnet

Agency broker and block trading specialist, Liquidnet, has appointed James Rubinstein as head of execution and quantitative services (EQS), Americas.

Based in New York, Rubinstein...

Primary concern : FIXing issuance

Efforts are underway to automate debt offerings and give the buy side greater control. Lynn Strongin Dodds reports.

Initial public and debt offerings can be...

Natwest Markets trading desk automating fixed income trading workflow with ipushpull

Natwest Markets has implemented a new PPQ (Pushpull Quotes) workflow system to streamline manual workflow around non-standard, complex trades such as fixed income trading.

Matthew...

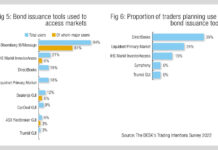

Will primary market tools fragment new issuance instead of standardising it?

Research by The DESK has found that buy-side traders have adopted a range of primary market tools to help them increase their efficiency at...

Dave Antonelli Joins IMTC from BlackRock

Fixed income technology provider IMTC has appointed Dave Antonelli as a strategic account executive within its sales team.

Antonelli has more than two decades of...

CME: Rising open interest in credit futures signals confidence in corporates

CME Group has seen a rapid rise in Open Interest (OI) for Bloomberg Credit Futures.

In the past two months, the number of these futures...

7 Chord’s appliance of science boosted with new hires

7 Chord, the provider of predictive analytics for sovereign and corporate bond prices to fixed income traders, issuers, and institutional investors, has appointed Andrew...

Why Europe’s electronic credit trading is accelerating

The level of electronic trading in European corporate bond markets has overtaken the US, according to analysis from firms including Propellant and Coalition Greenwich....

Deutsche Bank fined, again

Deutsche Bank (DBK) is still falling foul of its past misconduct. The Comisión Nacional del Mercado de Valores (CNMV), Spain's National Securities Market Commission,...

US Fixed Income Leaders Summit delayed

The Fixed Income Leaders Summit in Nashville which had been planned to take place in June 2020, has been postponed in light of the...

MarketAxess: The Open Trading inquiry orderbook

The Open Trading inquiry orderbook - An untapped source of liquidity insight

By David Krein, Chisom Amalunweze | 27 May 2021

Highlights

Inquiries available for Open...