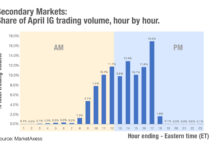

Chart of the week: When trading into the US, when should I trade?

Timing is everything in the markets, but not every market shares the same timing. It is common for trading desks to employ a trader...

Tradeweb joins forces with Boerse Stuttgart, sees Q2 revenues up 19%

Market operator Tradeweb is partnering with Boerse Stuttgart to offer the German exchange’s users direct access to liquidity in US bond trading. The exchange...

FILS USA 2023: Market volatility has tested e-trading and instrument selection

Having had a challenging and volatile first half of the year from a liquidity perspective, not least because of a crisis in US and...

ICMA recommends ECB follows Federal Reserve and SNB policies

The International Capital Markets Association (ICMA) has written to the European Central Bank (ECB) with a “concern that rising dysfunction in the market...

The Book: Who will drive reform in primary markets?

Primary market practices are under pressure to change, however the urgency and direction given for adaptation are often skewed by specific market participant groups.

The...

Deus X Capital invests in APEX:E3

Family office-backed investment and operating company Deus X Capital has announced its strategic investment in big data analytics and AI focused firm APEX:E3.

The company...

Parameta and ICAP launch interest rate swap volatility indices

Parameta Solutions, in partnership with ICAP G10 Rates, has launched a family of interest rate swap volatility indices designed to enhance the investment decision...

Barclays hit by US$450 million loss on ETNs

Barclays has reported it has made an estimated loss of US$450 million on exchange-traded notes (ETNs). As the bank noted in a statement, ETNs...

MiFID II has fallen short on transparency say traders

MiFID II has fallen short on transparency and will potentially create tiered access to market information, says Juan Landazabal, global head of fixed income...

Four drivers of Brazil’s increasingly complex corporate credit market

The Brazilian corporate credit market is becoming increasingly complex, and active bottom-up selection is essential for identifying winners and losers in this shifting environment.

That’s...

Onbrane launches primary debt market blockchain simulator

Onbrane, a provider of short-term debt market digitalisation technologies, has developed a primary debt market blockchain simulator, shadowing real transactions in a virtual blockchain...

Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...