Lipper: Bond funds come roaring back (with Fed’s help)

Refinitiv Lipper has seen a bounce back for bond funds in Q2 2020 after they suffered losses of -4.3% and outflows of US$208.9 billion...

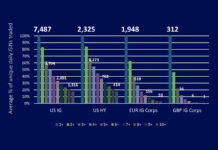

Comparing Corporate Bond Liquidity Across Regions

By Grant Lowensohn and Hidde Verholt.

Highlights

The US corporate bond market offers a significantly greater number of ISINs with high daily trade counts than other...

Vince Verhoeven joins Loomis Sayles

Loomis Sayles has named Vince Verhoeven as an investment director within its global bonds and emerging markets debt teams. The appointment follows increased interest...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Thailand’s Government Pension Fund taps Charles River for front office management

Thailand’s government pension fund has selected State Street subsidiary Charles River Development to modernise its front office operations and manage its domestic and international...

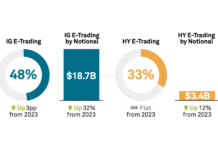

Coalition Greenwich: E-trading boom to outpace market growth in 2025

Nearly half of US investment grade corporate bond trading was electronic in 2024 – and this is only the start, Coalition Greenwich says.

In the...

Tech, not tape, needed to harness fixed income data

Asset managers' lives could be made easier if they had access to a high quality source of fixed income data – and the technology...

Millennium, Investortools solution to digitise muni market

Fixed income broker-dealer Millennium Advisors and Investortools, a provider of fixed-income software solutions, have partnered to simplify the manually intensive workflow of a typical...

Neptune 2.0 – How the new platform will deliver better investment and trading

Axe distribution service, Neptune, is evolving through a transformation of underlying technology, elevating its services to a new level.

Neptune’s CEO, John ‘Coach’ Robinson, and...

BoE amends collateral eligibility criteria for regulated covered bonds

The Bank of England is to amend the collateral eligibility criteria for regulated covered bonds in the Bank’s Sterling Monetary Framework.

From 1 September, to...

MTS turns 20 years of repo market experience and innovation towards the buy side

Sell-side dealers have long benefited from the efficiencies and liquidity that electronic trading brings to the Cash bond and Repo markets. Now, as it...

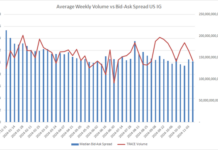

Visualising aggressive pricing pressure on trading costs

Analysing year-to-date volume and trade number data from MarketAxess’s TraX database for US credit, and correlating it with the weekly average MarketAxess CP+ bid-ask...