Re-designing the fixed income landscape

Benjamin Bécar, Fixed Income Product Manager at smartTrade Technologies believes that growing access to data is enabling buy-side firms to transform their trading workflow...

Tradeweb expands mortgage trading platform to originators

Fixed income market operator, Tradeweb, has expanded its platform for trading specified pools of mortgages, now enabling mortgage originators to trade alongside other secondary...

Will Pagano departure lead Citi to reset EM credit trading approach?

The departure of Marc Pagano, Citi’s managing director for emerging markets credit trading, has raised mixed feelings amongst buy-side traders. Although one in a...

FILS 2022: Deferral times priority for consolidated tape plans – EC’s Lueder

Plans for a consolidated tape for fixed income markets in Europe hinge on the “urgent priority” of harmonising post-trade publication windows – keeping them...

Versana to launch syndicated loan platform

Fintech firm Versana is to launch a syndicated loan platform, joining together banks, institutional lenders and their service providers in an effort to bring...

BoE sets code of conduct for repo and securities lending

A new voluntary Money Markets Code setting out the standards and best practice expected from participants in the deposit, repo and securities lending markets...

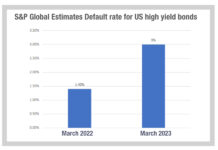

Rules and Ratings: Moody’s sees improving credit fundamentals driving leveraged finance deals

As interest rates decline, credit fundamentals will improve in 2025 and defaults will ease, according to analysis from credit rating agency Moody’s.

“Investors will hunt...

Agency Broker Hub : A look under the broker review hood

In this Agency Broker Hub column, Michelangelo Gigante, head of Execution Desk at Eurizon Capital SGR and Gherardo Lenti Capoduri, head of Market Hub,...

AFME: Buy- and sell-side debate value of new bond trading protocols

At the inaugural AFME Bond Trading, Innovation and Evolution Forum, panellists discussed the future opportunities of the international bond markets. As the discussion drew...

The enduring popularity of ‘Don’t Panic’

The phrase ‘Don’t Panic’ crops up frequently in comic fiction, notably in Douglas Adams’ book ‘Hitchhiker’s Guide to the Galaxy’ and in 1970’s British...

CTP authorisation duration remains unknown

While the CTP selection process is keeping to ESMA’s intended timeline, there is still uncertainty around when the tape will be implemented.

Once a provider...

Research: Fixed Income TCA Survey 2022

Better integration into trading workflow

The DESK’s execution research survey into fixed income TCA 2022.

Our research took in 40 major asset management firms’ use...

Subscriber