Andrew Bresler to lead Saxo UK

Online trading and investment firm Saxo has appointed Andrew Bresler as CEO of its UK business, effective 3 June. He replaces interim CEO Simon...

Tradeweb poaches Dan Cleaves to lead Dealerweb CLOB

Market operator Tradeweb has appointed Dan Cleaves, the former CEO of Brokertec Americas, as a managing director in its Dealerweb wholesale unit.

He said, “The...

Deutsche Bank fined, again

Deutsche Bank (DBK) is still falling foul of its past misconduct. The Comisión Nacional del Mercado de Valores (CNMV), Spain's National Securities Market Commission,...

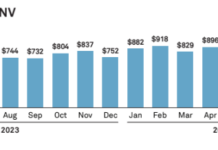

Tradeweb sees continued growth

Tradeweb has reported its average daily volume (ADV) in November was US$693 billion, an increase of 22% year-over-year, with continued broad-based growth in core...

E-trading stumbles in US credit

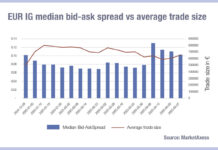

E-trading in high yield (HY) US credit reduced year-on-year (YoY) in February, despite rising average daily trade sizes.

After taking almost a third of traded...

IMTC launches new, streamlined platform

Fixed income technology specialist, IMTC, has launched a new and improved platform designed to enable fixed income investment managers to improve the accuracy and...

James Athey swaps abrdn for Marlborough

Integrated investment management and fund solutions group Marlborough has appointed James Athey as co-manager of the IFSL Marlborough Global Bond and IFSL Marlborough Bond...

Aladdin users gain Cassini support for derivatives trading

BlackRock has partnered with Cassini Systems, the pre- and post-trade margin and collateral analytics provider, to integrate Cassini analytics into BlackRock’s Aladdin order and...

Invesco’s 2023 Fixed income outlook: ‘A promising year after a painful selloff’

Invesco has published its outlook for fixed income markets in 2023, noting that valuations now look more attractive, and yields are higher than they...

Lucas Busch promoted at LGAM

L&G Asset Management has promoted Lucas Busch to head of US credit trading.

Busch has been with the firm since 2019 as a credit trader,...

Rules & Ratings: ‘Under review’ list shrinks at AM Best

Germania Farm Mutual Insurance Association is no longer categorised as ‘under review with negative implications’ by AM Best, and has been assigned a financial...

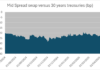

People’s Bank of China sets out northbound rules for Swap Connect

The People's Bank of China has issued interim measures to standardise the interest rate swap market between the mainland and Hong Kong, protecting investor...