Reimagining RFQ for Credit: The building blocks to a truly flexible approach

By Chioma Okoye, Managing Director, European Institutional Credit, Tradeweb

Innovation, automation and collaboration – the key to returning operational capacity back to the trader in order...

The Agency Broker Hub: Capital markets digitalisation is flying above the cloud

Loris Buscaino & Paolo Ferracuti, Brokerage & Execution, Market Hub, Intesa Sanpaolo IMI CIB Division.

Cloud-focused partnerships are initiatives that have gathered steam recently, due to...

Fed begins buying corporate bonds

The Federal Reserve Board has announced the Secondary Market Corporate Credit Facility (SMCCF), will begin buying a corporate bonds to support market liquidity and...

Strong start of the year in electronic credit trading

Electronic credit markets started 2025 on a strong note, with January's total credit average daily volume (ADV) showing robust growth across platforms. Trumid reported...

Securities financing: SFTR threatens smaller players

By Lynn Strongin Dodds.

The delay to the regulation gives market participants more breathing room but they should not get too comfortable. Lynn Strongin Dodds looks...

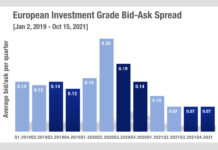

Seeing the pressure market makers are under in European credit

Secondary market data paints a picture of the challenges faced by sell-side market makers in the European corporate bond market during Q4. Information from...

Bond market venues tussle over market share amid volumes surge

Fixed income trading venues have reaped the rewards of rising trading volumes, but a highly competitive landscape is having an impact on market share.

Market...

David Blake leaves Northern Trust as director for Global Fixed Income

David Blake has left Northern Trust Global Investments as director for Global Fixed Income, after 15 years at the firm, following a restructuring of...

Viewpoint: Why bond traders are changing their habits

Informed traders are discovering that newer approaches to executing trades are more successful than older, habitual paths.

The DESK spoke with Max Callaghan of MarketAxess...

GSAM promotes Cohen to VP Credit Trader

Emma Cohen, credit trader at Goldman Sachs Asset Management Fixed Income, has been promoted to vice president, having been an associate credit trader since...

Aegon AM: Bond market liquidity fears ‘overblown’

Fears over a potential liquidity crisis in the corporate bond market are “significantly overblown”, according to Adrian Hull, head of core fixed income at...

Technology: What large language models do to the trading desk

LLMs are already adding value to trading teams.

The advent of Open AI’s Chat Generative Pre-trained Transformer (ChatGPT) tool has generated as many column inches...