Barclays hit by US$450 million loss on ETNs

Barclays has reported it has made an estimated loss of US$450 million on exchange-traded notes (ETNs). As the bank noted in a statement, ETNs...

Propellant.digital reports rapid uptake of its bond data analytics

Vincent Grandjean, CEO of analytics software provider Propellant.digital, is pleased with the firm’s progress to date.

“We are live with clients and bearing in mind...

Why buy-side firms are building their own primary market tools

Interoperability is not a competitive issue; clients will build it if platforms do not supply it.

There is not a consensus on who should make the bond...

John Miller to join First Eagle Investments

First Eagle Investments has established a new High Yield Municipal Credit team. John Miller will join First Eagle on 2 January 2024, as head...

Viewpoint: “Give me six hours to chop down a tree and I will spend...

Neptune’s COO, Byron Cooper-Fogarty, and head of data science, Ben Cohen, discuss the future of “axes” in the fixed income world.

Abraham Lincoln was a...

CFTC proposes changes to swaps reporting

The Commodity Futures Trading Commission (CFTC) has put forward two proposals, the first to amend certain rules regarding the reporting and information regulations applicable...

Enhancing the network effect in emerging markets e-trading

The friction of trading across a fragmented emerging market landscape is being drastically cut, says Dan Burke, MarketAxess.

The DESK spoke with Dan Burke, who...

TORA integrates BondCliQ’s US corporate bond consolidated quote and trade data

Order and execution management system (OEMS) provider, TORA, has integrated its OEMS with BondCliQ’s US corporate bond consolidated quote and trade data. The integration...

MarketAxess pushes muni e-trading with pricing engine expansion

Responding to growing interest in muni market e-trading, MarketAxess’s AI-powered electronic pricing engine CP+ is now available for municipal bonds.

Julien Alexandre, global head of...

Traders call time on outsized European market open hours

Buy- and sell-side traders have called for Europe to review its equity market open periods, which at eight and half hours is over 30%...

MarketAxess buys Deutsche Börse’s regulatory reporting business

Fixed income market operators and data provider, MarketAxess, has entered agreed to buy the Regulatory Reporting Hub, the regulatory reporting business of Deutsche Börse...

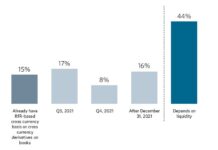

Bloomberg/PRMIA report finds liquidity barrier to RFR derivatives use

A new report by the Professional Risk Managers' International Association (PRMIA) and Bloomberg has found that while the majority (79%) of the firms with...