Simon Jones named head of credit markets EMEA at Citi

Simon Jones has been appointed head of credit markets trading for EMEA, in addition to his current role as head of global spread products...

Bank of England to embrace repo for liquidity management

Moving away from crisis-driven monetary actions, the Bank of England plans to manage liquidity through repurchase agreement (repo) practices rather than by purchasing large...

Bridgewise concludes series A funding

AI-based global securities analysis platform Bridgewise has raised US $21 million in series A funding, bringing its total raised capital to US $35 million.

The...

Greenwich: Nearly half of bond trading desk budgets now spent on technology

New research by Coalition Greenwich has found that the proportion of budget for fixed income trading desks spent on technology grew to 46% in...

Tradeweb executes first electronic SONIA swaps vs Gilt futures

Fixed income market operator Tradeweb has facilitated its first electronic execution of SONIA swaps against Gilt futures for institutional investors. The electronic transaction was...

Overbond and IPC partner on voice-to-AI supporting bond trading automation

Overbond has partnered with IPC, the communications and cloud connectivity service provider, to integrate IPC’s point-of-trade voice transaction data into Overbond’s artificial intelligence (AI)...

ICMA: Adopt data-driven approach to MIFIR RTS 2 post-trade deferral framework

The International Capital Market Association (ICMA) has co-signed a cross-industry statement on the MIFIR RTS 2 post-trade deferral framework for bonds, calling for a...

Liontrust – The trading team built for growth

Matt McLoughlin, partner and head of trading at Liontrust Asset Management, explains why expanding trading capabilities to match AUM and asset class growth needs...

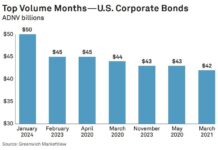

Credit: January sees largest average daily notional for US corporate bonds

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment...

Exploding post-MiFID II data myths

Gareth Coltman, Head of European Product Management at MarketAxess spoke to The DESK about the real impact MiFID II will have upon the data landscape.

How...

Citigroup Global Markets hit with $2.9m SEC underwriting expenses recordkeeping penalty

Citigroup Global Markets (CGMI) has settled a US$2.9 million penalty with the US Securities and Exchange Commission (SEC) for underwriting expenses recordkeeping violations.

The SEC...

MarketAxess volumes up 16.4%; EM and all-to-all lead growth

By Pia Hecher.

Venue operator and data provider MarketAxess has announced its second quarter results with significant upward trends in overall trading volume, including Open...