European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...

Mexican bond markets: Keep your friends close

Sitting next to the US in the current trade war meant that Mexico avoided the highest bracket of US tariffs, thanks to its existing...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

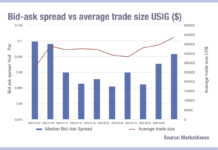

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

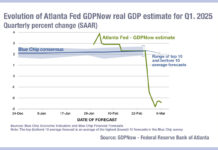

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

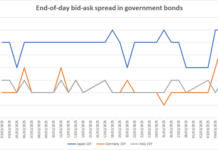

Orderly sell-off despite Bund bid-ask spread blow out

Borrowing costs for the German government spiked after an announcement of increased expenditure for its military, triggering a sell-off in German government bonds (bunds)...

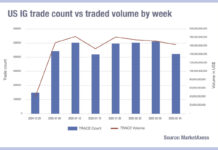

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...

The Book: Primary dealer positions climb rapidly, but concerns appear unfounded

Primary dealer positions of US Treasury holdings are expanding rapidly, but concern around restrictions on capacity are misplaced according to analysis.

A new paper by...

Origination: Brookings Institute: Threat from US debt levels very limited

A new paper by the Brookings Institute has highlighted reasons for concern around the growing US debt pile, and the dynamics that could affect...

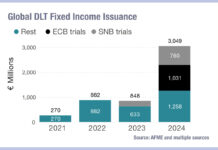

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...