Bond e-Trading prices still off; central banks adding to turmoil

Buy-side traders are still reporting “violent moves” in fixed income. In a liquidity crisis, investors are reliant on their asset managers’ traders to support...

The DESK’s Trading Intentions Survey 2020 : Unpicking the buy-side workflow

We reveal the buy side’s use of platforms for pre-trade data, executing orders in the market and trading venues.

Trading Intentions Survey highlights

Bloomberg has...

Subscriber

EMSs connect the dots in bond trading

Increased integration between venues and trading tools could herald far greater automation.

Moving a fixed income order from a portfolio manager to a counterparty is becoming...

Power to the people

New trading protocols can create paths to best execution or confound it through complexity. Chris Hall reports.

“Every nation gets the government it deserves” was...

CSDR mandatory buy-in delay welcomed

Umberto Menconi, head of Digital Markets Structures, Market Hub, Banca IMI, Intesa Sanpaolo Group

Since the financial crisis waves of new regulation and the need...

ICE freezes bond indices until 30th April

The Intercontinental Exchange’s (ICE’s) ICE Data Indices (IDI) has postponed the rebalancing of all the ICE and ICE BofA indices for bond, preferred and...

Greenwich Associates: Fixed income desks see highest buy-side tech spend

Technology spend on buy-side trading desks rose 4% in 2019 from the previous year, to reach US$2.2 million on average, with fixed-income trading desks...

Bond pricing battle shutters Nordic funds

Several Nordic fund managers have been shuttering fixed income funds, mainly in the corporate bond space, to allow them to get prices from banks...

Bond traders report screen prices are off by 10%

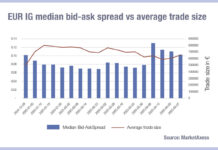

Several buy-side fixed income traders have confirmed that electronic prices are currently around 10% off the price that bonds are actually trading at, creating...

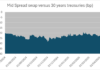

LSEG widens market maker spreads for government bonds, more ETFs

The London Stock Exchange Group has increased market-maker spreads to 5% for all exchange-traded products (ETPs), exchange-traded funds (ETFs) and UK government bonds -...