Why traders make better PMs

A new paper published by Gjergji Cici of the University of Kansas, with Philipp Schuster and Franziska Weishaupt, of the University of Stuttgart, has...

Coalition Greenwich: US Treasuries trading up 46% YoY in January

“The more the US government borrows (US$2.6 trillion in January), the more US Treasury traders trade.”

This activity, according to Coalition Greenwich’s Kevin McPartland, is...

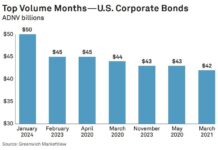

Credit: January sees largest average daily notional for US corporate bonds

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment...

Overbond integrates Neptune Networks axe data

Overbond, an AI-driven fixed income analytics and trade workflow automation provider, has integrated Neptune Networks’ axe data to help buy-side traders more efficiently discover...

Exclusive: Trumid hires former Neptune CTO Gavin Collins

Trumid has hired Neptune’s former chief technology and product officer, Gavin Collins.

The newly created role will see Collins head up Trumid’s dealer-to-client Attributed Trading...

Hargreaves Lansdown offers retail investors access to gilts in primary market

Hargreaves Lansdown is giving its clients access to Debt Management Office (DMO) Gilt auctions.

Tim Jacobs, head of primary markets, Hargreaves Lansdown, says, “This...

Daniel Collins swaps gold for rates at Aurel BGC

Daniel Collins has joined Aurel BGC to head up its futures and options (F&O) rates team in Dubai, a month after winning a gold...

MiFIR and MiFID II: Council adopts rules to support market data transparency

The Council of the European Union has adopted changes to the EU’s trading rules concerning the Markets in Financial Instruments Regulation (MiFIR) and the Markets in Financial Instruments...

Chris Gerlach joins MUFG

MUFG Securities Americas has hired Christopher Gerlach, a highly experienced credit derivatives and cash bond trader, as a director. He joins from BNP Paribas...

Aegon: Emerging market debt strong as sovereign default fears dissipate

Emerging Market Debt (EMD) is enjoying a “favourable” start to 2024, with growth, falling inflation and monetary easing trends across emerging economies acting as...