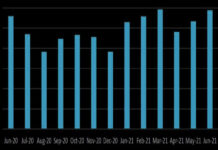

June sees European bond volume bounce back

European volumes in sovereign bonds traded in the secondary market continued to bounce back to its near 18-month peak, according to MarketAxess data, with...

Greco, founder of Direct Match, appointed MD at GTS… and he’s hiring

Jim Greco has been named managing director at market maker GTS, and has already launched a recruitment drive for coders to join his team.

Greco...

Mosaic Smart Data and Limeglass boost research analytics for banks

Analytics provider Mosaic Smart Data and Limeglass, the financial research specialist, have formed an alliance to help banks analyse research reports associated with client...

CME Group’s international rates ADV up 42% in Q2

Market operator and infrastructure provider CME Group has reported its international average daily volume (ADV) reached 5.1 million contracts in Q2 2021, up 6%...

TS Imagine and IHS Markit partner in European fixed income data

TS Imagine, the cloud-based multi-asset order and execution management system (OEMS) provider and IHS Markit have partnered to allow the OEMS TradeSmart platform, in...

Tradeweb announces first fully electronic SOFR swap spread trade

Market operator Tradeweb reports it has completed the first fully electronic institutional Secured Overnight Financing Rate (SOFR) swap spread trade. BlackRock and JP Morgan...

GreySpark: Buyer’s guide for cross-asset e-trading tools sets new expectations

Analyst firm GreySpark has released a new report on vendor-provided cross-asset e-trading solutions as a buyer’s guide to help traders, resetting expectations for the...

Tradeweb reports ADV in June up 35% year-on-year

Tradeweb has reported that its total trading volume for June 2021 reached US$23.1 trillion. Average daily volume (ADV) for the month was US$1.05 trillion,...

Glimpse Markets and TORA connect to support buy-side traders

Glimpse Markets, the buy-side data sharing hub, has partnered with order and execution management system (OEMS) provider TORA.

By connecting TORA’s OEMS with Glimpse...

EC to review mandatory buy-in rules under CSDR

The European Commission has stated that it will review the mandatory buy-in rules under the Central Securities Depository Regime (CSDR). The comments were made...