This page is dedicated to research articles with secondary market data provided by MarketAxess. For further information please contact Dan Barnes.

Home ‘BoB’ – Barnes on Bonds

‘BoB’ – Barnes on Bonds

SECONDARY MARKETS

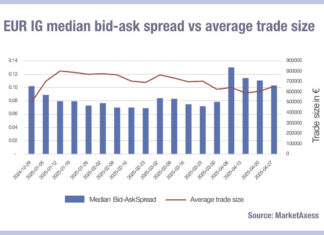

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according to MarketAxess’s CP+ data.

European high yield (HY) markets increasing to...

Excited or scared? The liquidity rollercoaster

Bid-ask spreads across all credit markets shot up in the week of 7 April, following the announcement of global tariffs on imports to the US on 2 April.

In US investment grade (IG), data from...

PRIMARY MARKETS

Citadel Securities challenge primary market conflicts

A year ago, rumours in the bond markets suggested that Citadel Securities might be planning a move into bond issuance, a move which buy-side traders regarded positively. Since the firm declined to become a...

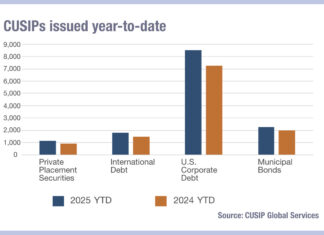

CUSIP issuance up YoY, but March decline signals concern

Year-to-date CUSIP issuance, which is indicative of new debt securities being issued, has increased year-to-date against 2024 figures, according to CUSIP Global Services (CGS).

Its latest CUSIP Issuance Trends Report for March 2025, which tracks the...