MARKET NEWS

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Liontrust loses McLoughlin

Head of trading Matthew McLoughlin has resigned from Liontrust Asset Management.

McLoughlin has been a partner and head of trading at the active investment management...

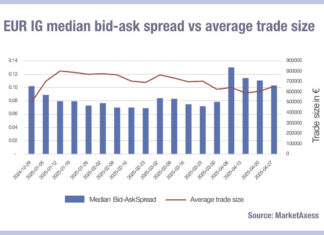

MarketAxess holds US credit trading high ground in April volatility

A burst of spread widening and credit ETF related trading pushed US electronic credit trading to another record in April.

TRACE volumes for investment grade...

Bloomberg broadens EM bond pricing coverage

Bloomberg has expanded its intraday valuation (IBVAL) front office service to cover emerging market (EM) bonds on a 22/5 basis.

Launched in 2023, IBVAL provides...

ICE Bonds builds on corporate bond volume records

ICE Bonds has introduced price improvement volume clearing (PIVC) to its risk matching auction (RMA) corporate bonds protocol.

RMA executes dealer-to-dealer sweep auctions, matching buyers...

FEATURES

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

PROFILES

RESEARCH

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

Subscriber

FROM THE ARCHIVES

Tradeweb launches iNAV calculation service with BlackRock onboard

Multi-asset marketplace operator, Tradeweb, has launched a market data service to calculate real-time Indicative Net Asset Values (iNAVs) for exchange-traded funds (ETFs). BlackRock became...

MayStreet expands cash treasury offering with Fenics data

MayStreet, the market data infrastructure provider, has added Fenics US Treasuries (Fenics UST) to its US cash treasury data portfolio. Owned and operated by...

FCA voices concern over buy-side transparency

By Pia Hecher.

The Financial Conduct Authority (FCA) has reported concern around cost-disclosures by asset managers, and following a ‘Call for Input’ (CfI), also detected concerns among...

Insights: PGIM: strong bond returns in 2025

Bonds will see strong cumulative returns in 2025, PGIM predicts, irrespective of poor Q4 2024 results

Since late 2022, the firm states that bonds have...

StoneX launches institutional credit offering in Asia

Dealer and market maker, StoneX Group, has launched its institutional credit offering in Asia, expanding the global debt capabilities of its fixed income division...

The DESK Research: Which trading protocols are buy-side firms using?

Primary research finds a distinct break between trading for active and passive portfolios across non-comp trading and auto-execution.

The DESK surveyed 30 buy-side trading...

Subscriber

Glue42 aims to boost buy and sell-side internal collaboration

Glue42, the desktop tools integration specialist, has released a new version of its open-source platform, Glue42 Core. The new release, version 2.0, is designed...

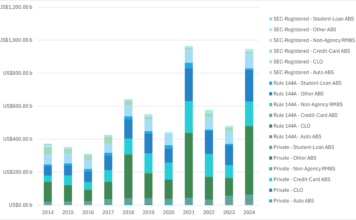

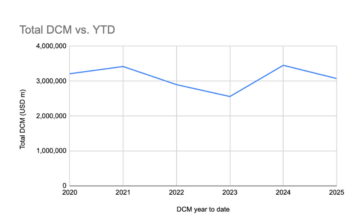

The Book: BofA DCM team give issuers confidence for financing in 2025

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

Chris Robinson joins Liquidnet

Liquidnet has appointed Chris Robinson as a multi-asset trader.

Robinson has more than a decade of industry experience, and joins Liquidnet from Louis Capital Markets.

Most...

Bajaj Finserv Asset Management adopts Bloomberg AIM

Bajaj Finserv Asset Management Limited (BFAML), has adopted AIM, the Bloomberg order and investment management system (O/IMS).

BFAML reportedly selected Bloomberg AIM in an effort...

LTX migrates corporate bond trading capabilities to AWS

LTX, a subsidiary of Broadridge Financial Solutions, has migrated its corporate bond e-trading platform to Amazon Web Services (AWS). With the completed migration, LTX...

Tradeweb sees August ADV jump 53.9%, MarketAxess up 39.6%

Trading platforms MarketAxess, Tradeweb and Trumid saw substantial increases in their average daily volumes for August compared to the same period last year. MarketAxess...